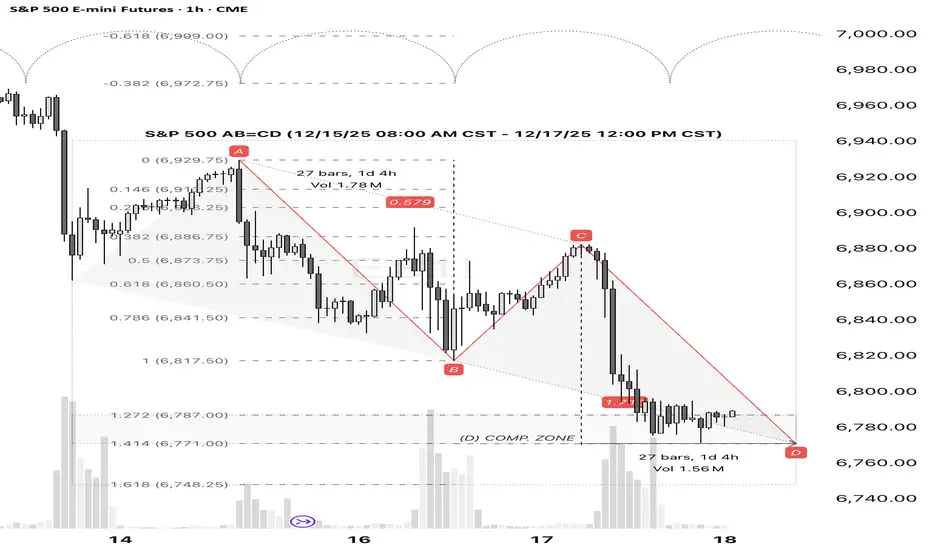

S&P 500 (SPX) - Technical Analysis: Bullish Reversal Signal at AB=CD Completion

1. Pattern Recognition:

A classic bullish AB=CD harmonic pattern has reached its precise completion point (D). This validates the designated support zone as a significant technical area where buyer momentum is anticipated to overcome recent selling pressure.

2. Market Structure Implications:

The successful completion of this pattern suggests:

· The establishment of a firm, technically-defined support level.

· Exhaustion of the prior downward (CD) leg.

· An increased probability of a mean-reversion move higher, targeting a retracement of the recent decline.

3. Trade Thesis & Risk Management:

The confluence at the D point presents a favorable risk/reward opportunity for a long position.

· Action: Initiate long positions.

· Entry Zone: At or near the pattern's D completion point.

· Invalidation Level: A decisive close below the D point invalidates the pattern structure. Place stop loss accordingly.

· Primary Target: The 0.618 Fibonacci retracement of the CD leg.

· Secondary Target: The initiation point (C) of the pattern.

1. Pattern Recognition:

A classic bullish AB=CD harmonic pattern has reached its precise completion point (D). This validates the designated support zone as a significant technical area where buyer momentum is anticipated to overcome recent selling pressure.

2. Market Structure Implications:

The successful completion of this pattern suggests:

· The establishment of a firm, technically-defined support level.

· Exhaustion of the prior downward (CD) leg.

· An increased probability of a mean-reversion move higher, targeting a retracement of the recent decline.

3. Trade Thesis & Risk Management:

The confluence at the D point presents a favorable risk/reward opportunity for a long position.

· Action: Initiate long positions.

· Entry Zone: At or near the pattern's D completion point.

· Invalidation Level: A decisive close below the D point invalidates the pattern structure. Place stop loss accordingly.

· Primary Target: The 0.618 Fibonacci retracement of the CD leg.

· Secondary Target: The initiation point (C) of the pattern.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。