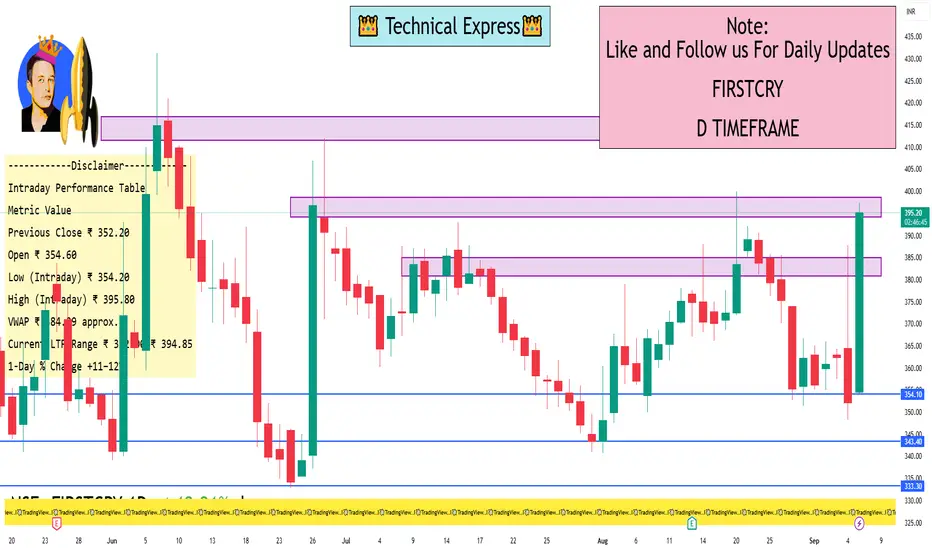

Intraday Overview (1-Day Time-Frame)

Current / Last Traded Price (LTP): ₹392–₹393 range, reflecting an ~11 % gain over the previous close of ₹352.20

Previous Close: ₹352.20

Intraday Percentage Gain: Approximately +11.3 %

VWAP (Volume Weighted Average Price): ₹384.39–₹384.85

Open / High / Low (Today):

Opening price around ₹354–₹355

Intraday range observed between low: ₹354.20 and high: ₹395.80

Interpretation & Insights

Brainbees Solutions is exhibiting strong intraday momentum, trading well above its VWAP—a typical indication of bullish sentiment among intraday traders (on 5 Sept, LTP ~₹352 earlier but now at ₹392–₹393, significantly above VWAP of ~₹384)

Such a movement suggests significant buying interest during the session, pushing both price and volume upward.

With a low intraday at ₹354.20, the stock had a wide trading range, potentially offering good intraday opportunity for active traders depending on entry/exit strategies.

What This Indicates

Strong Intraday Rally: The stock opened near the lower end of its trading range but surged sharply, trading well above VWAP—suggesting substantial buying momentum

High Volatility: With a wide range from ₹ 354 to ₹ 395, intraday traders had ample opportunity—though caution is advised in such volatile swings.

Bullish Sentiment: Momentum indicators like VWAP positioning and high-volatility trading are consistent with bullish intraday sentiment.

Current / Last Traded Price (LTP): ₹392–₹393 range, reflecting an ~11 % gain over the previous close of ₹352.20

Previous Close: ₹352.20

Intraday Percentage Gain: Approximately +11.3 %

VWAP (Volume Weighted Average Price): ₹384.39–₹384.85

Open / High / Low (Today):

Opening price around ₹354–₹355

Intraday range observed between low: ₹354.20 and high: ₹395.80

Interpretation & Insights

Brainbees Solutions is exhibiting strong intraday momentum, trading well above its VWAP—a typical indication of bullish sentiment among intraday traders (on 5 Sept, LTP ~₹352 earlier but now at ₹392–₹393, significantly above VWAP of ~₹384)

Such a movement suggests significant buying interest during the session, pushing both price and volume upward.

With a low intraday at ₹354.20, the stock had a wide trading range, potentially offering good intraday opportunity for active traders depending on entry/exit strategies.

What This Indicates

Strong Intraday Rally: The stock opened near the lower end of its trading range but surged sharply, trading well above VWAP—suggesting substantial buying momentum

High Volatility: With a wide range from ₹ 354 to ₹ 395, intraday traders had ample opportunity—though caution is advised in such volatile swings.

Bullish Sentiment: Momentum indicators like VWAP positioning and high-volatility trading are consistent with bullish intraday sentiment.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.