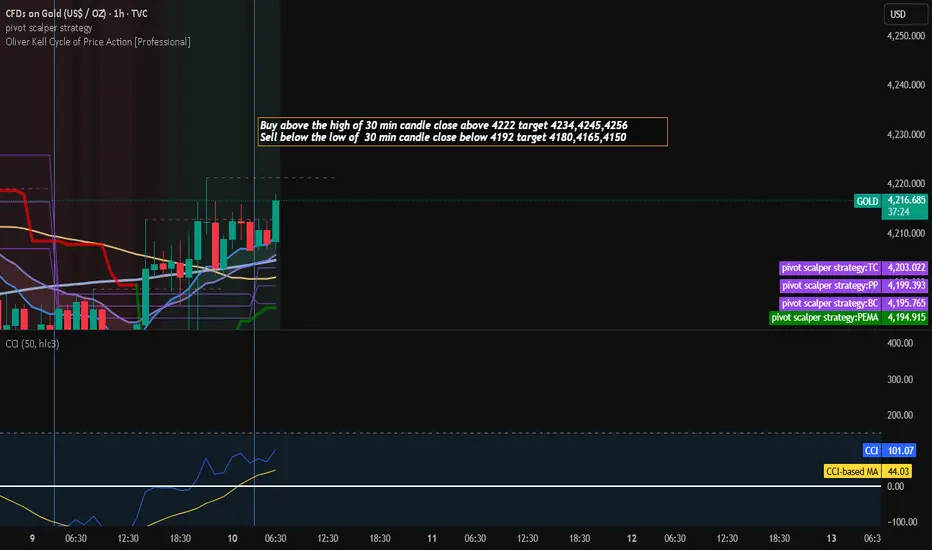

📊 GOLD INTRADAY TRADE SETUP (30-MIN STRATEGY)

🟢 BUY SETUP (Long Trade)

Trigger:

✔️ Enter ONLY if a 30-minute candle closes ABOVE 4222

✔️ Buy above the high of that breakout candle

🎯 Targets:

TP1: 4234

TP2: 4245

TP3: 4256

🛡️ Stop-Loss Suggestion:

Below the breakout candle low

Or place SL around 4210 (example; adjust based on your analysis)

📌 Notes:

Confirm breakout strength using volume or momentum indicators (e.g., RSI > 55).

Avoid buying if price breaks above 4222 but closes back below it (fakeout).

🔻 SELL SETUP (Short Trade)

Trigger:

✔️ Enter ONLY if a 30-minute candle closes BELOW 4192

✔️ Sell below the low of that breakdown candle

🎯 Targets:

TP1: 4180

TP2: 4165

TP3: 4150

🛡️ Stop-Loss Suggestion:

Above the breakdown candle high

Or place SL around 4205 (example; based on volatility)

📌 Notes:

Confirm breakdown strength with volume or RSI < 45.

Be cautious during sudden reversals or news events.

⚠️ RISK MANAGEMENT (Highly Recommended)

🧮 Risk per trade: 1–2% of your capital maximum

🎯 Follow target-to-stop ratio minimum 1:2 for quality trades

🕒 Avoid trading during high-impact news (US data, Fed events, etc.)

📉 Do NOT trade sideways 30-min candles—wait for real breakout or breakdown.

📝 DISCLAIMER

⚠️ This analysis is for educational and informational purposes only. It is not investment advice or a recommendation to buy or sell any financial instrument. Trading in gold or any market involves significant risk. Please consult with your financial advisor before taking any trades. You are responsible for your own trading decisions.

🟢 BUY SETUP (Long Trade)

Trigger:

✔️ Enter ONLY if a 30-minute candle closes ABOVE 4222

✔️ Buy above the high of that breakout candle

🎯 Targets:

TP1: 4234

TP2: 4245

TP3: 4256

🛡️ Stop-Loss Suggestion:

Below the breakout candle low

Or place SL around 4210 (example; adjust based on your analysis)

📌 Notes:

Confirm breakout strength using volume or momentum indicators (e.g., RSI > 55).

Avoid buying if price breaks above 4222 but closes back below it (fakeout).

🔻 SELL SETUP (Short Trade)

Trigger:

✔️ Enter ONLY if a 30-minute candle closes BELOW 4192

✔️ Sell below the low of that breakdown candle

🎯 Targets:

TP1: 4180

TP2: 4165

TP3: 4150

🛡️ Stop-Loss Suggestion:

Above the breakdown candle high

Or place SL around 4205 (example; based on volatility)

📌 Notes:

Confirm breakdown strength with volume or RSI < 45.

Be cautious during sudden reversals or news events.

⚠️ RISK MANAGEMENT (Highly Recommended)

🧮 Risk per trade: 1–2% of your capital maximum

🎯 Follow target-to-stop ratio minimum 1:2 for quality trades

🕒 Avoid trading during high-impact news (US data, Fed events, etc.)

📉 Do NOT trade sideways 30-min candles—wait for real breakout or breakdown.

📝 DISCLAIMER

⚠️ This analysis is for educational and informational purposes only. It is not investment advice or a recommendation to buy or sell any financial instrument. Trading in gold or any market involves significant risk. Please consult with your financial advisor before taking any trades. You are responsible for your own trading decisions.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。