📉 Technical Indicators

Relative Strength Index (RSI): Approximately 35.08, indicating the stock is nearing oversold conditions but not yet in the oversold zone.

Moving Average Convergence Divergence (MACD): Around -6.02, suggesting a bearish trend.

Moving Averages:

5-day EMA: ₹957.70 (Sell)

10-day EMA: ₹963.20 (Sell)

20-day EMA: ₹961.06 (Sell)

50-day EMA: ₹981.06 (Sell)

100-day EMA: ₹974.24 (Sell)

200-day EMA: ₹921.92 (Buy)

The short-term moving averages are indicating sell signals, while the long-term 200-day EMA is showing a buy signal.

Pivot Points:

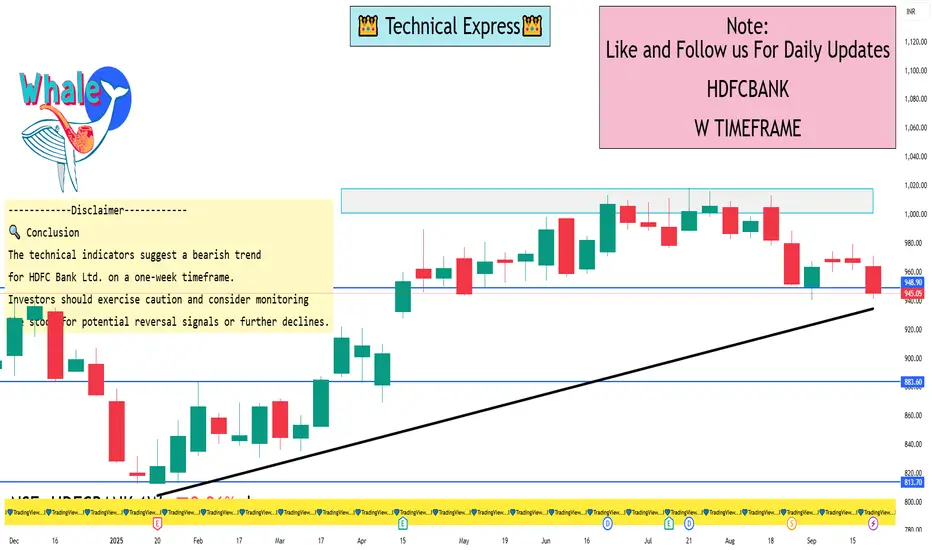

Support Levels: ₹929.82 (S3), ₹936.53 (S2), ₹943.52 (S1)

Resistance Levels: ₹957.22 (R1), ₹963.93 (R2), ₹970.92 (R3)

These levels can help identify potential price reversal points.

📊 Price Action

The stock closed at ₹945.05 on September 26, 2025, marking a 0.51% decline from the previous close. Over the past week, the share price has decreased by 2.26%.

⚠️ Recent Developments

HDFC Bank is currently facing regulatory challenges, including a ban by the Dubai Financial Services Authority from accepting new clients or initiating new business activities through its branch at the Dubai International Financial Centre. This could impact investor sentiment and the bank's international operations.

🔍 Conclusion

The technical indicators suggest a bearish trend for HDFC Bank Ltd. on a one-week timeframe. Investors should exercise caution and consider monitoring the stock for potential reversal signals or further declines.

Relative Strength Index (RSI): Approximately 35.08, indicating the stock is nearing oversold conditions but not yet in the oversold zone.

Moving Average Convergence Divergence (MACD): Around -6.02, suggesting a bearish trend.

Moving Averages:

5-day EMA: ₹957.70 (Sell)

10-day EMA: ₹963.20 (Sell)

20-day EMA: ₹961.06 (Sell)

50-day EMA: ₹981.06 (Sell)

100-day EMA: ₹974.24 (Sell)

200-day EMA: ₹921.92 (Buy)

The short-term moving averages are indicating sell signals, while the long-term 200-day EMA is showing a buy signal.

Pivot Points:

Support Levels: ₹929.82 (S3), ₹936.53 (S2), ₹943.52 (S1)

Resistance Levels: ₹957.22 (R1), ₹963.93 (R2), ₹970.92 (R3)

These levels can help identify potential price reversal points.

📊 Price Action

The stock closed at ₹945.05 on September 26, 2025, marking a 0.51% decline from the previous close. Over the past week, the share price has decreased by 2.26%.

⚠️ Recent Developments

HDFC Bank is currently facing regulatory challenges, including a ban by the Dubai Financial Services Authority from accepting new clients or initiating new business activities through its branch at the Dubai International Financial Centre. This could impact investor sentiment and the bank's international operations.

🔍 Conclusion

The technical indicators suggest a bearish trend for HDFC Bank Ltd. on a one-week timeframe. Investors should exercise caution and consider monitoring the stock for potential reversal signals or further declines.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。