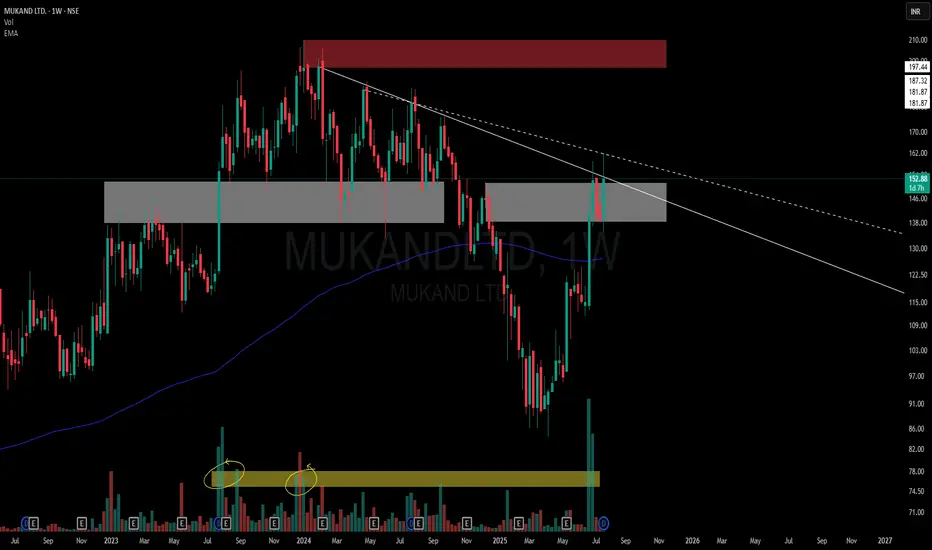

This chart is a visual case study of how price behaves when historic supply meets structural compression.

📌 Structural Highlights:

⚪ Primary Descending Trendline – Clean and persistent resistance from the top, still unbroken in a meaningful way.

▫️ Secondary Dotted Trendline – Shorter-term descending pressure also in play, giving us a dual resistance dynamic.

🟫 Strong Overhead Supply – Marked in red, this zone has held significance multiple times in the past.

⚪ Active Flip Zone – A broad grey zone showing a role reversal from supply to demand, currently interacting with price again.

📊 Volume Belt:

-Highlighted Yellow Volume Belt at the bottom shows repeated heavy interest.

🧠 Not a call – Just a neutral lens on structural context and how the market respects its own footprints.

📌 Structural Highlights:

⚪ Primary Descending Trendline – Clean and persistent resistance from the top, still unbroken in a meaningful way.

▫️ Secondary Dotted Trendline – Shorter-term descending pressure also in play, giving us a dual resistance dynamic.

🟫 Strong Overhead Supply – Marked in red, this zone has held significance multiple times in the past.

⚪ Active Flip Zone – A broad grey zone showing a role reversal from supply to demand, currently interacting with price again.

📊 Volume Belt:

-Highlighted Yellow Volume Belt at the bottom shows repeated heavy interest.

🧠 Not a call – Just a neutral lens on structural context and how the market respects its own footprints.

🎯 Master My Self-Made Trading Strategy

📈 Telegram (Learn Today): t.me/hashtaghammer

✅ WhatsApp (Learn Today): wa.me/919455664601

📈 Telegram (Learn Today): t.me/hashtaghammer

✅ WhatsApp (Learn Today): wa.me/919455664601

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

🎯 Master My Self-Made Trading Strategy

📈 Telegram (Learn Today): t.me/hashtaghammer

✅ WhatsApp (Learn Today): wa.me/919455664601

📈 Telegram (Learn Today): t.me/hashtaghammer

✅ WhatsApp (Learn Today): wa.me/919455664601

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。