📊 NIFTY TRADING PLAN — 02 DEC 2025

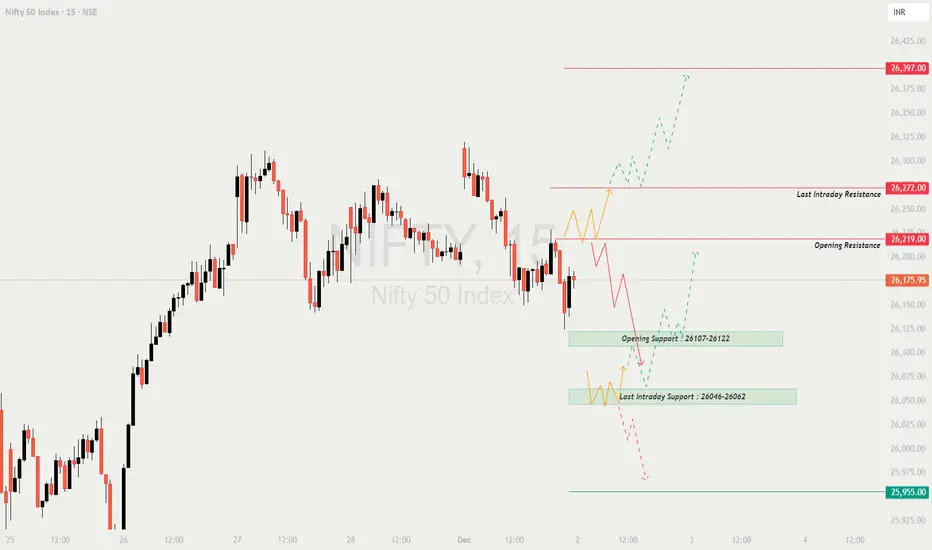

Nifty closed near 26,175, right between the Opening Resistance (26,219) and Opening Support (26,107–26,122).

The market is currently in a low-momentum, direction-hunting phase, where the opening behaviour will determine the next trend leg.

The structure shows clean supply zones above and strong demand zones below, meaning both sides have potential — but only confirmation-based trading is safe.

🔍 Key Intraday Levels

🟥 Opening Resistance: 26,219

🟥 Last Intraday Resistance: 26,272

🟥 Major Breakout Level: 26,397

🟩 Opening Support: 26,107 – 26,122

🟩 Last Intraday Support: 26,046 – 26,062

🟩 Major Breakdown Level: 25,955

🟢 SCENARIO 1 — GAP-UP OPENING (100+ Points)

If Nifty opens near 26,260–26,300, price opens right at or above resistance.

📘 Educational Note:

A gap-up directly into resistance requires patience.

Breakouts without retests often fail.

Retests confirm whether buyers truly control the level.

🟧 SCENARIO 2 — FLAT OPENING (26,150–26,190)

A flat open places Nifty between support and resistance. Expect early indecision.

💡 Educational Tip:

Flat openings give the cleanest structure of the day.

Wait for the breakout from the initial range (first 3–4 candles).

Impulse moves from the flat zone lead to strong trends.

🔻 SCENARIO 3 — GAP-DOWN OPENING (100+ Points)

If Nifty opens around 26,050–26,090, price enters the demand zones.

📘 Educational Note:

Gap-downs into strong support often cause big traps for late sellers.

Wait for price to show exhaustion before buying —

Higher low + strong bullish candle = safest reversal pattern.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 💡

⚠️ Golden Rule:

Be a risk manager first, a trader second.

Capital safety guarantees longevity.

📌 SUMMARY

Bullish Bias Above:

✔️ 26,219 → 26,272 → 26,330 → 26,397

Bearish Bias Below:

✔️ 26,122 → 26,062 → 26,046 → 25,955

Reversal Zones:

🟩 26,107 – 26,122 (Opening Support)

🟩 26,046 – 26,062 (Last Intraday Support)

🟥 26,219 – 26,272 (Heavy Resistance)

Danger / No-Trade Zone:

⚠️ 26,165–26,200 (Choppy, low-quality zone)

🧾 CONCLUSION

Nifty is at a decisive stage where both sides are open.

The day’s trend will be controlled by these key triggers:

✔️ Bullish only above 26,219

✔️ Bearish below 26,122

✔️ Strong breakout only above 26,272

✔️ Major breakdown only below 25,955

Trade with confirmation, respect levels, and avoid emotional entries.

Let market structure guide your trades — not impulses.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is purely for educational purposes.

Please consult your financial advisor before making trading decisions.

Nifty closed near 26,175, right between the Opening Resistance (26,219) and Opening Support (26,107–26,122).

The market is currently in a low-momentum, direction-hunting phase, where the opening behaviour will determine the next trend leg.

The structure shows clean supply zones above and strong demand zones below, meaning both sides have potential — but only confirmation-based trading is safe.

🔍 Key Intraday Levels

🟥 Opening Resistance: 26,219

🟥 Last Intraday Resistance: 26,272

🟥 Major Breakout Level: 26,397

🟩 Opening Support: 26,107 – 26,122

🟩 Last Intraday Support: 26,046 – 26,062

🟩 Major Breakdown Level: 25,955

🟢 SCENARIO 1 — GAP-UP OPENING (100+ Points)

If Nifty opens near 26,260–26,300, price opens right at or above resistance.

- []If price sustains above 26,219 for 10–15 minutes →

Upside targets: 26,272 → 26,330 → 26,397

This zone becomes a continuation breakout if volumes support.

[]If Nifty rejects 26,219–26,272 (wick rejections, long red candle) →

Expect a retracement towards:

➡️ 26,175 → 26,122

[]Best Long Setup:

Breakout above 26,272 → Retest → Bullish candle → Target 26,330 / 26,397

[]Avoid early shorting on gap-ups —

fakes are common near resistance clusters.

📘 Educational Note:

A gap-up directly into resistance requires patience.

Breakouts without retests often fail.

Retests confirm whether buyers truly control the level.

🟧 SCENARIO 2 — FLAT OPENING (26,150–26,190)

A flat open places Nifty between support and resistance. Expect early indecision.

- []Upside trigger → Break and sustain above 26,219.

Targets → 26,272 → 26,330

[]Downside trigger → Break below 26,122.

Targets → 26,062 → 26,046

[]The zone 26,175–26,200 is a noise range. Avoid trading inside it.

[]Two safe setups:

✔️ Breakout & Retest above 26,219

✔️ Breakdown & Retest below 26,122

💡 Educational Tip:

Flat openings give the cleanest structure of the day.

Wait for the breakout from the initial range (first 3–4 candles).

Impulse moves from the flat zone lead to strong trends.

🔻 SCENARIO 3 — GAP-DOWN OPENING (100+ Points)

If Nifty opens around 26,050–26,090, price enters the demand zones.

- []If support 26,062–26,046 holds and higher-low structure forms →

Reversal upside targets → 26,122 → 26,175 → 26,219

[]If 26,046 breaks →

Sharp downside possible →

➡️ 26,000 → 25,955 (major support)

This is a crucial liquidity zone.

[]Only sell BELOW 25,955 with confirmation.

Targets: 25,900 → 25,850

[]Reversal trades are valid ONLY after a bullish confirmation candle in the support zone.

📘 Educational Note:

Gap-downs into strong support often cause big traps for late sellers.

Wait for price to show exhaustion before buying —

Higher low + strong bullish candle = safest reversal pattern.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 💡

- []Avoid trading the first 5 minutes after the open.

[]Use ATM or ITM options for directional trades.

[]Set SL based on chart level, not premium price.

[]Never average a losing trade — cut and re-enter if needed.

[]Trail stop-loss after first target to lock profits.

[]Weekly expiry days → avoid overtrading during volatility spikes. - High VIX → Prefer spreads over naked buying.

⚠️ Golden Rule:

Be a risk manager first, a trader second.

Capital safety guarantees longevity.

📌 SUMMARY

Bullish Bias Above:

✔️ 26,219 → 26,272 → 26,330 → 26,397

Bearish Bias Below:

✔️ 26,122 → 26,062 → 26,046 → 25,955

Reversal Zones:

🟩 26,107 – 26,122 (Opening Support)

🟩 26,046 – 26,062 (Last Intraday Support)

🟥 26,219 – 26,272 (Heavy Resistance)

Danger / No-Trade Zone:

⚠️ 26,165–26,200 (Choppy, low-quality zone)

🧾 CONCLUSION

Nifty is at a decisive stage where both sides are open.

The day’s trend will be controlled by these key triggers:

✔️ Bullish only above 26,219

✔️ Bearish below 26,122

✔️ Strong breakout only above 26,272

✔️ Major breakdown only below 25,955

Trade with confirmation, respect levels, and avoid emotional entries.

Let market structure guide your trades — not impulses.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is purely for educational purposes.

Please consult your financial advisor before making trading decisions.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。