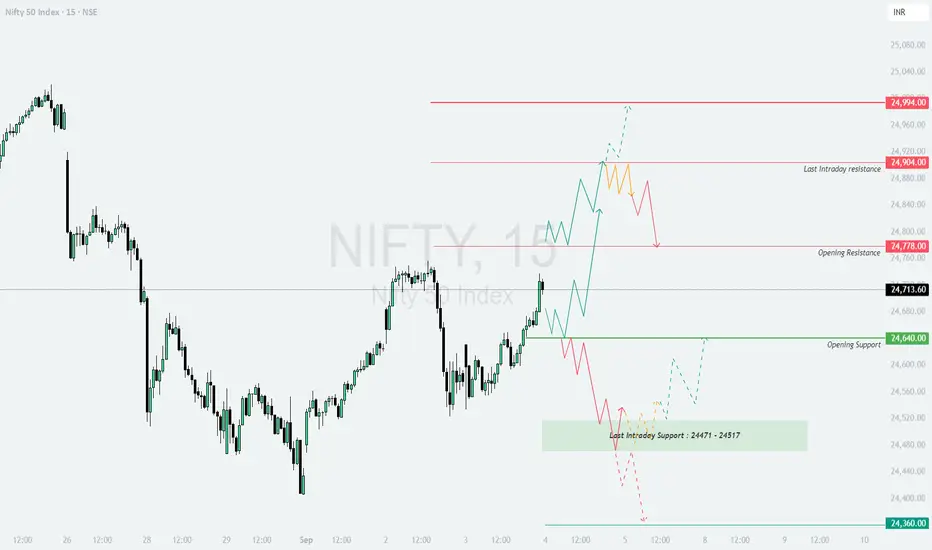

NIFTY TRADING PLAN – 04-Sep-2025

📌 Key Levels to Watch:

Opening Resistance: 24,778

Last Intraday Resistance: 24,904

Major Resistance: 24,994

Opening Support: 24,640

Last Intraday Support Zone: 24,471 – 24,517

Buyer’s Support: 24,360

These levels will guide intraday trend direction. Let’s break down scenarios.

🔼 1. Gap-Up Opening (100+ points above 24,778)

If Nifty opens above 24,778, bulls will try to push it higher towards 24,904 (Last Intraday Resistance) and eventually test 24,994 (Major Resistance).

📌 Plan of Action:

👉 Educational Note: In strong gap-ups, chasing early moves can be risky. Safer entries often come on retests of support levels.

➖ 2. Flat Opening (Around 24,640 – 24,713)

A flat start near the current zone shows balance between buyers and sellers. Price will look for a trigger from support/resistance.

📌 Plan of Action:

👉 Educational Note: Flat openings usually consolidate in the first 30 minutes; patience helps avoid false breakouts.

🔽 3. Gap-Down Opening (100+ points below 24,640)

If Nifty opens weak below 24,640, sellers may dominate the session.

📌 Plan of Action:

👉 Educational Note: In gap-downs, avoid aggressive longs unless there is a strong reversal confirmation.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 24,778 → Upside towards 24,904 – 24,994.

🟧 Flat Opening → Watch 24,640 for support, 24,778 for breakout.

🔴 Below 24,640 → Weakness towards 24,471 – 24,517; next support 24,360.

⚠️ Key Decision Zone: 24,640 (Opening Support) will act as the pivot.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered investment advice. Please consult your financial advisor before trading.

📌 Key Levels to Watch:

Opening Resistance: 24,778

Last Intraday Resistance: 24,904

Major Resistance: 24,994

Opening Support: 24,640

Last Intraday Support Zone: 24,471 – 24,517

Buyer’s Support: 24,360

These levels will guide intraday trend direction. Let’s break down scenarios.

🔼 1. Gap-Up Opening (100+ points above 24,778)

If Nifty opens above 24,778, bulls will try to push it higher towards 24,904 (Last Intraday Resistance) and eventually test 24,994 (Major Resistance).

📌 Plan of Action:

- [] Sustaining above 24,778 can invite upside momentum. Targets: 24,904 → 24,994.

[] Near 24,904, expect volatility as sellers may book profits. - If rejection comes from 24,904, price may fall back towards 24,778.

👉 Educational Note: In strong gap-ups, chasing early moves can be risky. Safer entries often come on retests of support levels.

➖ 2. Flat Opening (Around 24,640 – 24,713)

A flat start near the current zone shows balance between buyers and sellers. Price will look for a trigger from support/resistance.

📌 Plan of Action:

- [] Holding above 24,640 (Opening Support) will keep momentum positive, opening path to 24,778 → 24,904.

[] If it fails to hold 24,640, expect a drift towards Last Intraday Support 24,471 – 24,517. - Avoid trades in the middle zone; clarity comes only when price breaks key levels.

👉 Educational Note: Flat openings usually consolidate in the first 30 minutes; patience helps avoid false breakouts.

🔽 3. Gap-Down Opening (100+ points below 24,640)

If Nifty opens weak below 24,640, sellers may dominate the session.

📌 Plan of Action:

- [] A gap-down below 24,640 will likely test the 24,471 – 24,517 zone.

[] Breakdown below this zone could extend weakness towards 24,360 (Buyer’s Support). - If 24,360 holds, expect a technical bounce; else, further downside may unfold.

👉 Educational Note: In gap-downs, avoid aggressive longs unless there is a strong reversal confirmation.

🛡️ Risk Management Tips for Options Traders

- [] Always place a stop loss on hourly close basis.

[] Risk only 1–2% of capital per trade.

[] Use scaling out strategy (book partial profits at first target, ride balance till next).

[] Avoid holding OTM options deep into expiry week to reduce time decay risk. - Use option spreads like Bull Call or Bear Put when volatility is high.

📌 Summary & Conclusion

🟢 Above 24,778 → Upside towards 24,904 – 24,994.

🟧 Flat Opening → Watch 24,640 for support, 24,778 for breakout.

🔴 Below 24,640 → Weakness towards 24,471 – 24,517; next support 24,360.

⚠️ Key Decision Zone: 24,640 (Opening Support) will act as the pivot.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered investment advice. Please consult your financial advisor before trading.

免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.