📈 11-Day Technical Overview

Over the past 11 trading days, the index has experienced a modest upward movement, indicating a neutral to mildly bullish trend. Key technical indicators suggest a balanced market sentiment:

Relative Strength Index (RSI): Hovering around neutral levels, indicating neither overbought nor oversold conditions.

Moving Average Convergence Divergence (MACD): Currently showing a bullish crossover, suggesting potential upward momentum.

Average Directional Index (ADX): At approximately 22.69, with a Positive Directional Indicator (PDI) at 27.41 and a Negative Directional Indicator (MDI) at 14.54, indicating a mild bullish trend.

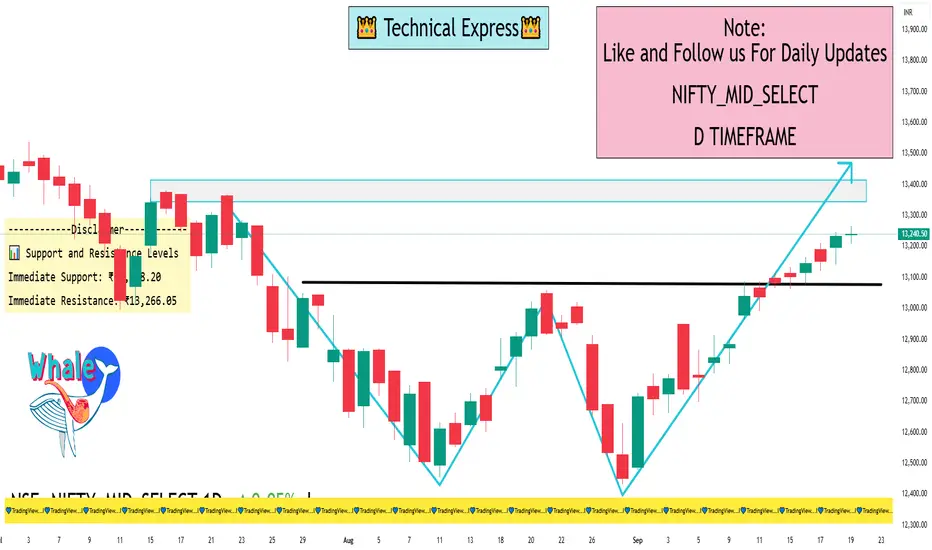

📊 Support and Resistance Levels

Immediate Support: ₹13,208.20

Immediate Resistance: ₹13,266.05

A breakout above the resistance level could signal a continuation of the upward trend, while a dip below support may indicate a potential reversal.

📌 Investment Options

Investors interested in gaining exposure to the Nifty Midcap Select Index can consider the following options:

Exchange-Traded Funds (ETFs): These funds replicate the performance of the index and can be traded on the stock exchange.

Index Funds: Mutual funds that aim to mirror the index's performance.

Futures & Options: Derivative contracts based on the index, suitable for more experienced investors.

Direct Stock Investment: Investing in the constituent stocks of the index in the same proportion as the index.

Over the past 11 trading days, the index has experienced a modest upward movement, indicating a neutral to mildly bullish trend. Key technical indicators suggest a balanced market sentiment:

Relative Strength Index (RSI): Hovering around neutral levels, indicating neither overbought nor oversold conditions.

Moving Average Convergence Divergence (MACD): Currently showing a bullish crossover, suggesting potential upward momentum.

Average Directional Index (ADX): At approximately 22.69, with a Positive Directional Indicator (PDI) at 27.41 and a Negative Directional Indicator (MDI) at 14.54, indicating a mild bullish trend.

📊 Support and Resistance Levels

Immediate Support: ₹13,208.20

Immediate Resistance: ₹13,266.05

A breakout above the resistance level could signal a continuation of the upward trend, while a dip below support may indicate a potential reversal.

📌 Investment Options

Investors interested in gaining exposure to the Nifty Midcap Select Index can consider the following options:

Exchange-Traded Funds (ETFs): These funds replicate the performance of the index and can be traded on the stock exchange.

Index Funds: Mutual funds that aim to mirror the index's performance.

Futures & Options: Derivative contracts based on the index, suitable for more experienced investors.

Direct Stock Investment: Investing in the constituent stocks of the index in the same proportion as the index.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。