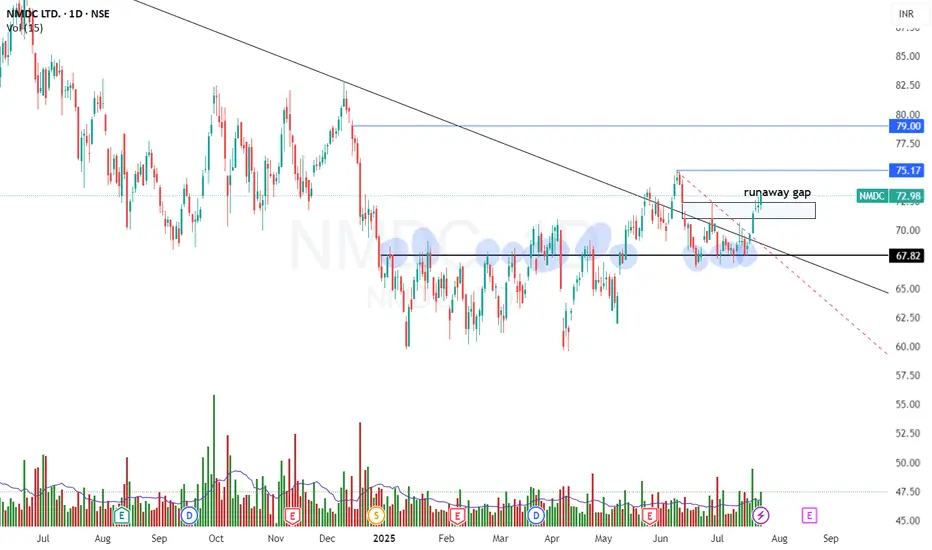

📈 NMDC – Bullish Trend Reversal with Breakout Setup (For Study Purpose Only)

NMDC has displayed a bullish trend reversal following a prolonged 6-month consolidation between ₹60–68. The stock broke out decisively above this range and has since retested the breakout zone successfully, confirming it as a strong support.

Subsequently, the stock entered a 1-month sideways consolidation between ₹67–73, forming a tight base—typically a sign of strength and potential continuation.

🔍 Technical Highlights:

✅ Breakout Zone: ₹68 (now acting as strong support)

🔁 Retest Completed: Post-breakout pullback respected support

🧱 Current Range: ₹70–73 (tight consolidation near highs)

📊 Volume: Gradual increase near resistance, indicating accumulation

📈 RSI & MACD: RSI climbing steadily; MACD shows bullish crossover

🎯 Trade Setup (for study purpose only):

Watch for strength above: ₹73

Stop-Loss (SL): ₹69

Targets: ₹75 (initial), ₹80–82 (extended)

📌 Note:

This analysis is intended for educational and study purposes only. Always conduct your own due diligence or consult a certified financial advisor before making any investment decisions.

NMDC has displayed a bullish trend reversal following a prolonged 6-month consolidation between ₹60–68. The stock broke out decisively above this range and has since retested the breakout zone successfully, confirming it as a strong support.

Subsequently, the stock entered a 1-month sideways consolidation between ₹67–73, forming a tight base—typically a sign of strength and potential continuation.

🔍 Technical Highlights:

✅ Breakout Zone: ₹68 (now acting as strong support)

🔁 Retest Completed: Post-breakout pullback respected support

🧱 Current Range: ₹70–73 (tight consolidation near highs)

📊 Volume: Gradual increase near resistance, indicating accumulation

📈 RSI & MACD: RSI climbing steadily; MACD shows bullish crossover

🎯 Trade Setup (for study purpose only):

Watch for strength above: ₹73

Stop-Loss (SL): ₹69

Targets: ₹75 (initial), ₹80–82 (extended)

📌 Note:

This analysis is intended for educational and study purposes only. Always conduct your own due diligence or consult a certified financial advisor before making any investment decisions.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。