### Market Structure & Context

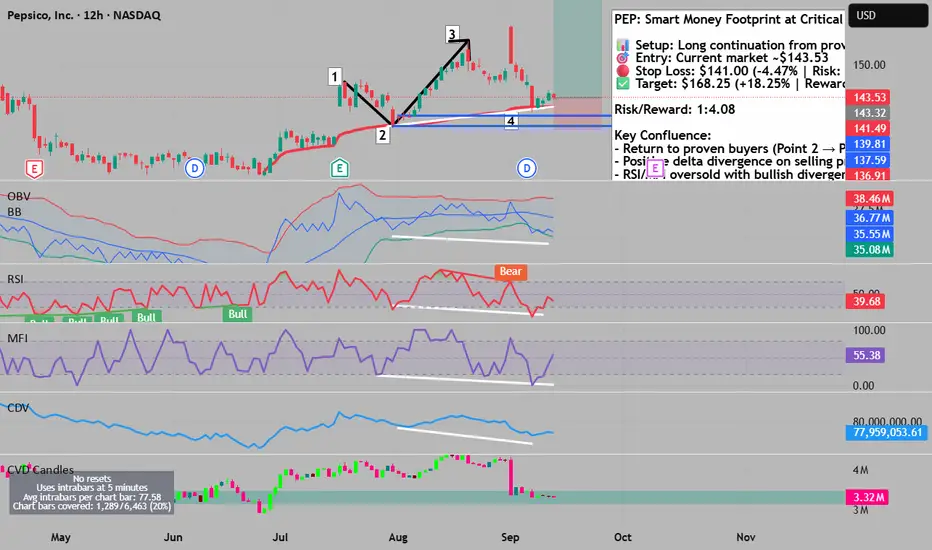

PepsiCo has demonstrated a robust uptrend architecture spanning May through September, establishing a clear sequence of higher highs and higher lows. The current retracement presents a textbook opportunity as price revisits a proven demand zone where institutional buyers previously stepped in with conviction.

The numbered wave structure reveals critical market psychology:

- Point 1 → 3: Breakout confirmation with close above initial resistance

- Point 2: Established as verified institutional accumulation zone

- Point 3 → 4: Natural retracement returning to test proven buyers

### Volume Footprint Intelligence

The granular footprint analysis exposes sophisticated accumulation patterns invisible on traditional charts:

Monday Sept 8: Despite aggressive selling with multiple imbalances, price rejected and closed above a buying imbalance zone. The positive delta on a bearish bar signals hidden institutional absorption of retail selling.

Tuesday Sept 9: Three stacked bullish imbalances formed while price pushed lower—classic absorption pattern. Negative delta divergence confirms smart money accumulating into weakness.

Wednesday Sept 10: Clean bullish close above imbalance with supporting positive delta—accumulation phase transitioning to markup.

Thursday Sept 11: Price conquered the value area high/low of previous three sessions with dual bullish imbalances and positive delta confirmation.

### Multi-Timeframe Oscillator Divergences

The technical mosaic presents compelling bullish divergences across multiple indicators:

- RSI & MFI: Both oscillators display oversold conditions at Point 4 while price forms a higher high versus Point 2—textbook positive divergence

- OBV: Piercing the lower Bollinger Band deviation signals exhausted selling pressure

- CDV: Price returned to pre-discovery consolidation zone—historically a high-probability reversal area

### Anchored VWAP Confluence

The anchored VWAP from the momentum initiation point provides dynamic support precisely at Points 2 and 4, confirming this level as algorithmically significant for institutional participants.

### Risk Management Framework

Entry Zone: $143.53 (current market price)

Stop Loss: $141.00 (-4.47% from entry | Risk: $750 per contract)

Take Profit: $168.25 (+18.25% from entry | Reward: $2,616 per contract)

Risk/Reward Ratio: 1:4.08 — exceptional asymmetric opportunity

Position Sizing: With a 4.08:1 reward-to-risk ratio, this setup offers substantial upside with controlled downside. Size position according to account risk tolerance (1-2% max risk recommended).

### Trade Execution Strategy

Entry Tactics:

- Primary entry at current levels ~$143.53

- Scale-in opportunity on any dip toward $142.50

- Confirmation entry on break above $144.50

Exit Strategy:

- Initial Target: $150.00 (psychological level) — consider taking 25% profits

- Secondary Target: $157.00 (halfway point) — reduce another 25%

- Final Target: $168.25 — exit remaining position or trail stop for continuation

Stop Management:

- Initial stop at $141.00 (below Point 2 support)

- Trail to breakeven once price reaches $150.00

- Trail to $145.00 when price hits $157.00

### Probability Assessment

This setup combines multiple high-conviction factors:

✅ Trend alignment (5-month uptrend intact)

✅ Volume structure confirmation (positive delta divergences)

✅ Technical indicator confluence (4+ bullish signals)

✅ Institutional footprint patterns (absorption visible)

✅ Risk/reward extremely favorable (1:4.08)

✅ Stop placed below critical support structure

The convergence of footprint intelligence, traditional technical analysis, and exceptional risk/reward creates an institutional-grade opportunity. The 4.08:1 reward-to-risk ratio means even with a 25% win rate, this strategy remains profitable long-term.

⚠️ Disclaimer: This analysis represents technical observations only. Always conduct your own due diligence and manage position size according to your risk tolerance.

PepsiCo has demonstrated a robust uptrend architecture spanning May through September, establishing a clear sequence of higher highs and higher lows. The current retracement presents a textbook opportunity as price revisits a proven demand zone where institutional buyers previously stepped in with conviction.

The numbered wave structure reveals critical market psychology:

- Point 1 → 3: Breakout confirmation with close above initial resistance

- Point 2: Established as verified institutional accumulation zone

- Point 3 → 4: Natural retracement returning to test proven buyers

### Volume Footprint Intelligence

The granular footprint analysis exposes sophisticated accumulation patterns invisible on traditional charts:

Monday Sept 8: Despite aggressive selling with multiple imbalances, price rejected and closed above a buying imbalance zone. The positive delta on a bearish bar signals hidden institutional absorption of retail selling.

Tuesday Sept 9: Three stacked bullish imbalances formed while price pushed lower—classic absorption pattern. Negative delta divergence confirms smart money accumulating into weakness.

Wednesday Sept 10: Clean bullish close above imbalance with supporting positive delta—accumulation phase transitioning to markup.

Thursday Sept 11: Price conquered the value area high/low of previous three sessions with dual bullish imbalances and positive delta confirmation.

### Multi-Timeframe Oscillator Divergences

The technical mosaic presents compelling bullish divergences across multiple indicators:

- RSI & MFI: Both oscillators display oversold conditions at Point 4 while price forms a higher high versus Point 2—textbook positive divergence

- OBV: Piercing the lower Bollinger Band deviation signals exhausted selling pressure

- CDV: Price returned to pre-discovery consolidation zone—historically a high-probability reversal area

### Anchored VWAP Confluence

The anchored VWAP from the momentum initiation point provides dynamic support precisely at Points 2 and 4, confirming this level as algorithmically significant for institutional participants.

### Risk Management Framework

Entry Zone: $143.53 (current market price)

Stop Loss: $141.00 (-4.47% from entry | Risk: $750 per contract)

Take Profit: $168.25 (+18.25% from entry | Reward: $2,616 per contract)

Risk/Reward Ratio: 1:4.08 — exceptional asymmetric opportunity

Position Sizing: With a 4.08:1 reward-to-risk ratio, this setup offers substantial upside with controlled downside. Size position according to account risk tolerance (1-2% max risk recommended).

### Trade Execution Strategy

Entry Tactics:

- Primary entry at current levels ~$143.53

- Scale-in opportunity on any dip toward $142.50

- Confirmation entry on break above $144.50

Exit Strategy:

- Initial Target: $150.00 (psychological level) — consider taking 25% profits

- Secondary Target: $157.00 (halfway point) — reduce another 25%

- Final Target: $168.25 — exit remaining position or trail stop for continuation

Stop Management:

- Initial stop at $141.00 (below Point 2 support)

- Trail to breakeven once price reaches $150.00

- Trail to $145.00 when price hits $157.00

### Probability Assessment

This setup combines multiple high-conviction factors:

✅ Trend alignment (5-month uptrend intact)

✅ Volume structure confirmation (positive delta divergences)

✅ Technical indicator confluence (4+ bullish signals)

✅ Institutional footprint patterns (absorption visible)

✅ Risk/reward extremely favorable (1:4.08)

✅ Stop placed below critical support structure

The convergence of footprint intelligence, traditional technical analysis, and exceptional risk/reward creates an institutional-grade opportunity. The 4.08:1 reward-to-risk ratio means even with a 25% win rate, this strategy remains profitable long-term.

⚠️ Disclaimer: This analysis represents technical observations only. Always conduct your own due diligence and manage position size according to your risk tolerance.

Join our public discord : discord.gg/hUUhRKByFt

To access my premium indicators , including unrestricted usage of public indicators ( all timeframes ) : whop.com/chaos-theory-indicator-s-5/?store=true

To access my premium indicators , including unrestricted usage of public indicators ( all timeframes ) : whop.com/chaos-theory-indicator-s-5/?store=true

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Join our public discord : discord.gg/hUUhRKByFt

To access my premium indicators , including unrestricted usage of public indicators ( all timeframes ) : whop.com/chaos-theory-indicator-s-5/?store=true

To access my premium indicators , including unrestricted usage of public indicators ( all timeframes ) : whop.com/chaos-theory-indicator-s-5/?store=true

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。