Intraday Overview

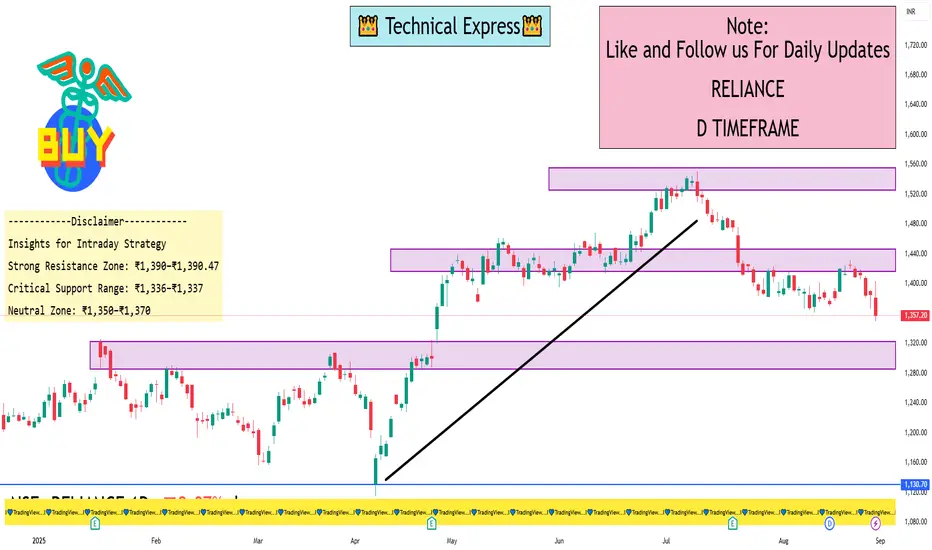

Current Price: ~₹1,357.20 (as of August 29, 2025), reflecting a -2.07% drop from the previous close

Daily Price Range:

Open: ₹1,381.10

High: ₹1,403.50

Low: ₹1,350.00

This indicates a volatile session with a significant pullback from intraday highs.

Key Metrics & Context

One-Day Return: Approximately -2.08%, aligning with both Economic Times and Investing.com data

Recent Trend: The stock has seen a modest correction of around -4.23% over the past month

Support Zone: Technical commentary suggests buyers stepping in near ₹1,400–₹1,410, placing this zone as a key support area on the daily chart

Volatility & Market Movement:

NSE data confirms a high intraday range between ₹1,350 and ₹1,403

Beta and VWAP metrics reinforce its typical intraday behavior

Final Take

Reliance Industries closed the day down ~2%, revealing intraday vulnerability after failing to sustain gains above ₹1,400. If that support holds, a short-term rebound could follow. Otherwise, a deeper dip toward ₹1,350–₹1,360 remains on the table.

Current Price: ~₹1,357.20 (as of August 29, 2025), reflecting a -2.07% drop from the previous close

Daily Price Range:

Open: ₹1,381.10

High: ₹1,403.50

Low: ₹1,350.00

This indicates a volatile session with a significant pullback from intraday highs.

Key Metrics & Context

One-Day Return: Approximately -2.08%, aligning with both Economic Times and Investing.com data

Recent Trend: The stock has seen a modest correction of around -4.23% over the past month

Support Zone: Technical commentary suggests buyers stepping in near ₹1,400–₹1,410, placing this zone as a key support area on the daily chart

Volatility & Market Movement:

NSE data confirms a high intraday range between ₹1,350 and ₹1,403

Beta and VWAP metrics reinforce its typical intraday behavior

Final Take

Reliance Industries closed the day down ~2%, revealing intraday vulnerability after failing to sustain gains above ₹1,400. If that support holds, a short-term rebound could follow. Otherwise, a deeper dip toward ₹1,350–₹1,360 remains on the table.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。