Topic Statement:

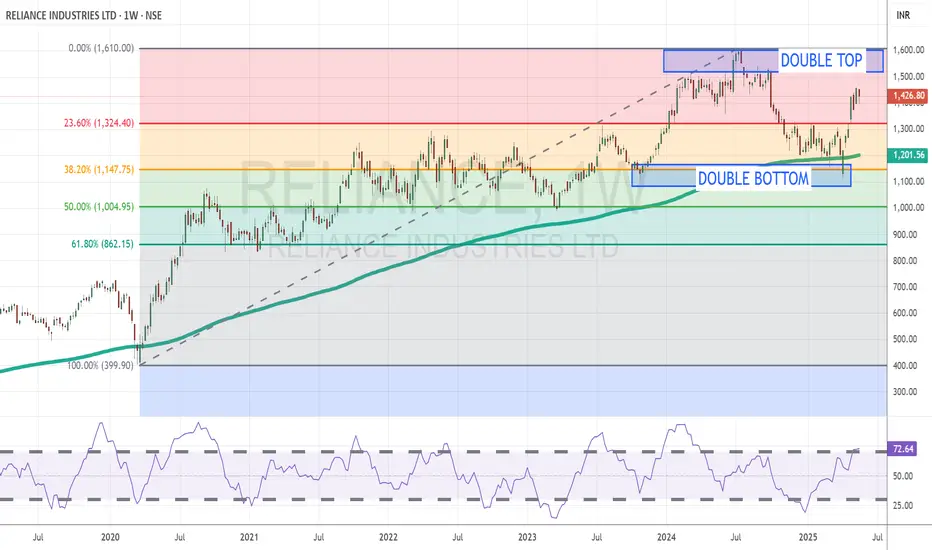

Reliance is in a strong bullish phase, continuing its recovery momentum after a solid technical reversal.

Key Points:

The stock reversed sharply from a double bottom pattern at the 38.2% Fibonacci retracement level, offering strong support.

It received an additional bullish push at the 23.6% level, reinforcing upward momentum.

The price is approaching its lifetime high of 1161, where a double top formation is likely and could act as a profit-booking zone due to expected resistance.

Now trading above the 180-day EMA, the stock is technically overbought, suggesting a potential pause or pullback near the peak.

Reliance is in a strong bullish phase, continuing its recovery momentum after a solid technical reversal.

Key Points:

The stock reversed sharply from a double bottom pattern at the 38.2% Fibonacci retracement level, offering strong support.

It received an additional bullish push at the 23.6% level, reinforcing upward momentum.

The price is approaching its lifetime high of 1161, where a double top formation is likely and could act as a profit-booking zone due to expected resistance.

Now trading above the 180-day EMA, the stock is technically overbought, suggesting a potential pause or pullback near the peak.

免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.