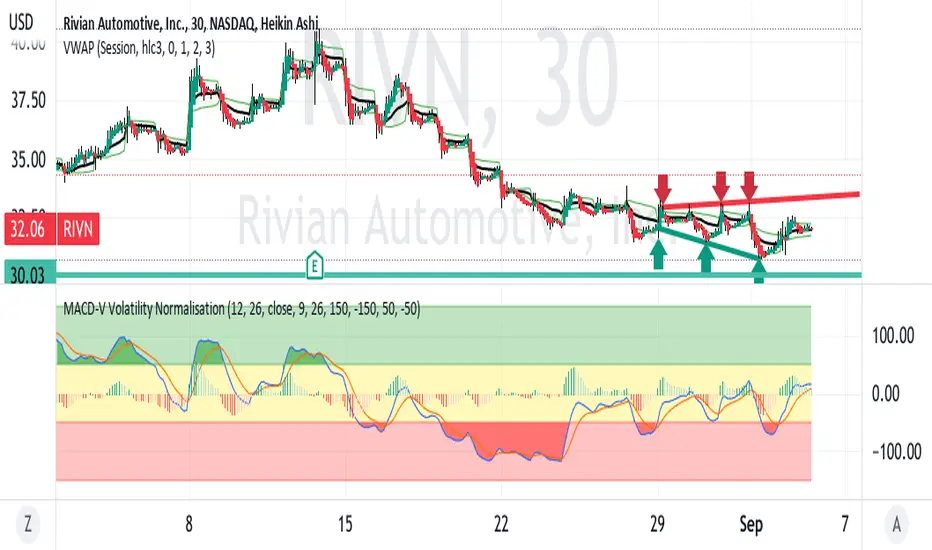

RIVN is in a slow down trending pattern right now within a megaphone

reflecting increasing volatility. The MACD shows the downward momentum

with more of the histogram negative below the zero level.

At present, the K / D lines are crossing over and above the histogram.

characteristic of a reversal to the downside.

Based on pivots in June and July, the horizontal support is at ~ $30.

Accordingly, a target on a short trade setup is just before $30.

This appears to be a good short trade setup where Rivian is

following the downtrend of the sector leader TSLA.

reflecting increasing volatility. The MACD shows the downward momentum

with more of the histogram negative below the zero level.

At present, the K / D lines are crossing over and above the histogram.

characteristic of a reversal to the downside.

Based on pivots in June and July, the horizontal support is at ~ $30.

Accordingly, a target on a short trade setup is just before $30.

This appears to be a good short trade setup where Rivian is

following the downtrend of the sector leader TSLA.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。