https://www.tradingview.com/x/0Np0lrx6/

In short:

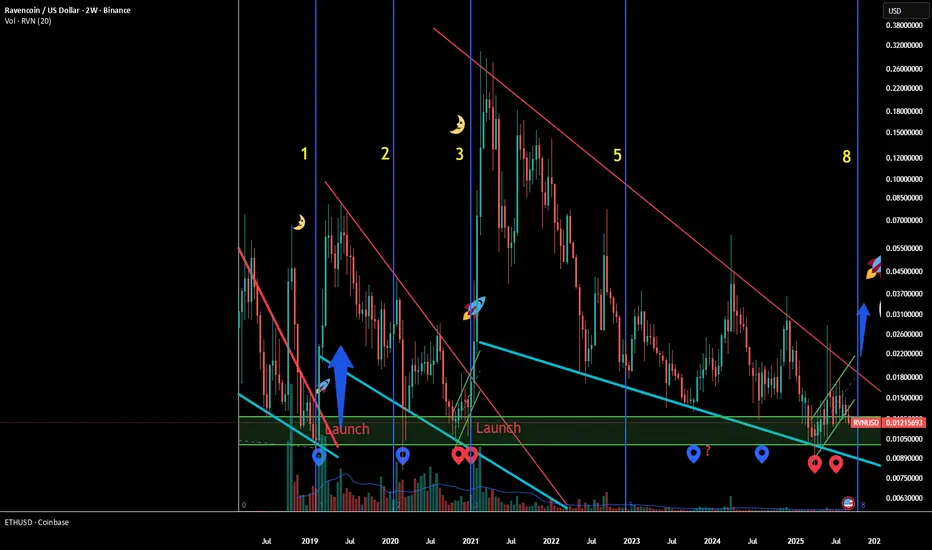

RVN’s breakouts lined up with Fibonacci time counts before.

Zone 1 → 2019 breakout.

Zone 3 → 2021 breakout.

Zone 8 → Oct 27, 2025?

If history rhymes, Ravencoin may be preparing its next moonshot right on schedule. 🚀

Ravencoin’s launchpads have followed a surprising Fibonacci rhythm.

⏳ The Time Structure

Zone 1 (2018–2019): From genesis until the bar just before the first breakout (Feb 2019).

Zone 2: Skipped.

Zone 3 (2020–2021): From bottoming until Jan 2021 — again, the bar just before breakout.

Zone 5: Skipped.

Zone 8 (2025): If the same rhythm holds, we are now approaching the next critical launchpad.

📌 By extrapolation, the Fibonacci sequence (1–2–3–5–8) suggests the next breakout window opens around 27 October 2025.

🧩 Why it matters

RVN’s history shows not just price fractals, but time fractals.

Each parabola was preceded by a Fibonacci-timed compression phase.

Skipping intermediate numbers (2, 5) makes the hits at 1, 3, and now 8 stand out even more.

🎯 Projection

Breakout could ignite in late October 2025.

Potential parabola similar to 2019 and 2021 cycles.

Target range: $0.25 → $0.50 if structure repeats.

📉 Bearish gift scenario

The current chart still carries a bearish bias.

A dip to $0.010–$0.009 cannot be excluded.

Instead of invalidating the setup, such a move would act as a final spring.

For long-term holders this is a gift — a last clean add opportunity before liftoff.

📚 Educational sidebar: Why Fibonacci often aligns with market cycles

The Fibonacci sequence (1, 2, 3, 5, 8, 13…) is not mystical — it’s structural.

Nature & growth: Plants, shells, galaxies, all grow in Fibonacci ratios.

Human behavior: Financial markets are driven by collective psychology. Fear, greed, and crowd timing often cluster around these proportions.

Markets: Traders unknowingly reinforce these rhythms by using Fibonacci retracements, extensions, and time zones.

👉 The result? Market cycles often “breathe” in Fibonacci counts — not perfectly, but frequently enough to create repeating patterns.

In short:

RVN’s breakouts lined up with Fibonacci time counts before.

Zone 1 → 2019 breakout.

Zone 3 → 2021 breakout.

Zone 8 → Oct 27, 2025?

If history rhymes, Ravencoin may be preparing its next moonshot right on schedule. 🚀

Ravencoin’s launchpads have followed a surprising Fibonacci rhythm.

⏳ The Time Structure

Zone 1 (2018–2019): From genesis until the bar just before the first breakout (Feb 2019).

Zone 2: Skipped.

Zone 3 (2020–2021): From bottoming until Jan 2021 — again, the bar just before breakout.

Zone 5: Skipped.

Zone 8 (2025): If the same rhythm holds, we are now approaching the next critical launchpad.

📌 By extrapolation, the Fibonacci sequence (1–2–3–5–8) suggests the next breakout window opens around 27 October 2025.

🧩 Why it matters

RVN’s history shows not just price fractals, but time fractals.

Each parabola was preceded by a Fibonacci-timed compression phase.

Skipping intermediate numbers (2, 5) makes the hits at 1, 3, and now 8 stand out even more.

🎯 Projection

Breakout could ignite in late October 2025.

Potential parabola similar to 2019 and 2021 cycles.

Target range: $0.25 → $0.50 if structure repeats.

📉 Bearish gift scenario

The current chart still carries a bearish bias.

A dip to $0.010–$0.009 cannot be excluded.

Instead of invalidating the setup, such a move would act as a final spring.

For long-term holders this is a gift — a last clean add opportunity before liftoff.

📚 Educational sidebar: Why Fibonacci often aligns with market cycles

The Fibonacci sequence (1, 2, 3, 5, 8, 13…) is not mystical — it’s structural.

Nature & growth: Plants, shells, galaxies, all grow in Fibonacci ratios.

Human behavior: Financial markets are driven by collective psychology. Fear, greed, and crowd timing often cluster around these proportions.

Markets: Traders unknowingly reinforce these rhythms by using Fibonacci retracements, extensions, and time zones.

👉 The result? Market cycles often “breathe” in Fibonacci counts — not perfectly, but frequently enough to create repeating patterns.

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。