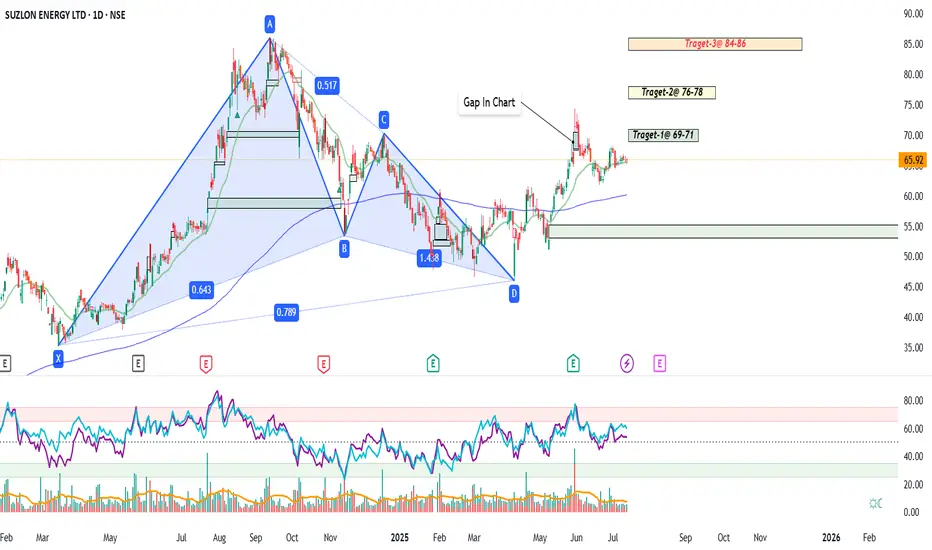

Suzlon Energy – CMP:65.92

•Looking at the chart, Suzlon has just completed a Bullish Harmonic Bat Pattern. After the “D” point was hit, the stock bounced nicely, and it’s now consolidating around ₹66 – which could be the calm before the next move.

•RSI is sitting around 60, which is healthy – not overbought, so room to go higher.

•Volume has picked up recently after the bounce from point D, suggesting buyers are stepping in.

✅ Entry Idea

Right now, Suzlon is trading around ₹66, just above its key EMAs. This is a solid zone to start building a position.

• You can enter around ₹65–67.

• If the stock dips a little more, ₹63–64 is a great place to average or initiate as well (near the 50 EMA).

🔒 Stop Loss

To manage risk:

• Place your stop loss below ₹59.50, just under the 200 EMA and the last structure support.

• If you want a tighter SL, go with ₹61 (that still keeps you safe).

🎯 Target Zones (Think in 3 Stages)

As per the pattern aiming for multiple levels as the pattern unfolds and price fills the upside gaps:

1. Target 1: ₹69-71 – This is a nearby resistance and short-term goal.

2. Target 2: ₹76-78 – There's a visible price gap here + past selling zone.

3. Target 3: ₹84–86 – This is the harmonic target, where the full pattern projects to.

Keep in mind, you don’t have to ride it all the way – partial booking at each target is a smart move.

📌 Thanks a ton for checking out my idea! Hope it sparked some value for you.

🙏 Follow for more insights

👍 Boost if you found it helpful

✍️ Drop a comment with your thoughts below!

•Looking at the chart, Suzlon has just completed a Bullish Harmonic Bat Pattern. After the “D” point was hit, the stock bounced nicely, and it’s now consolidating around ₹66 – which could be the calm before the next move.

•RSI is sitting around 60, which is healthy – not overbought, so room to go higher.

•Volume has picked up recently after the bounce from point D, suggesting buyers are stepping in.

✅ Entry Idea

Right now, Suzlon is trading around ₹66, just above its key EMAs. This is a solid zone to start building a position.

• You can enter around ₹65–67.

• If the stock dips a little more, ₹63–64 is a great place to average or initiate as well (near the 50 EMA).

🔒 Stop Loss

To manage risk:

• Place your stop loss below ₹59.50, just under the 200 EMA and the last structure support.

• If you want a tighter SL, go with ₹61 (that still keeps you safe).

🎯 Target Zones (Think in 3 Stages)

As per the pattern aiming for multiple levels as the pattern unfolds and price fills the upside gaps:

1. Target 1: ₹69-71 – This is a nearby resistance and short-term goal.

2. Target 2: ₹76-78 – There's a visible price gap here + past selling zone.

3. Target 3: ₹84–86 – This is the harmonic target, where the full pattern projects to.

Keep in mind, you don’t have to ride it all the way – partial booking at each target is a smart move.

📌 Thanks a ton for checking out my idea! Hope it sparked some value for you.

🙏 Follow for more insights

👍 Boost if you found it helpful

✍️ Drop a comment with your thoughts below!

トレード稼働中

Suzlon Energy appears poised for further upside as several bullish technical patterns are visible on the chart. The stock has recently broken out of a falling wedge, and a golden cross is observed, suggesting strengthening bullish momentum. Additionally, a cup and handle pattern is forming, further supporting the potential for upward movement. These signals indicate a favorable setup, and higher targets may be achievable in the near term.

ノート

NoteKeep yourself updated with Idea Worth your time, join my Channel on whatsapp": ""The Crocodile Strategy"

whatsapp.com/channel/0029Vb6zQU1DDmFMeeYP7g0w

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。