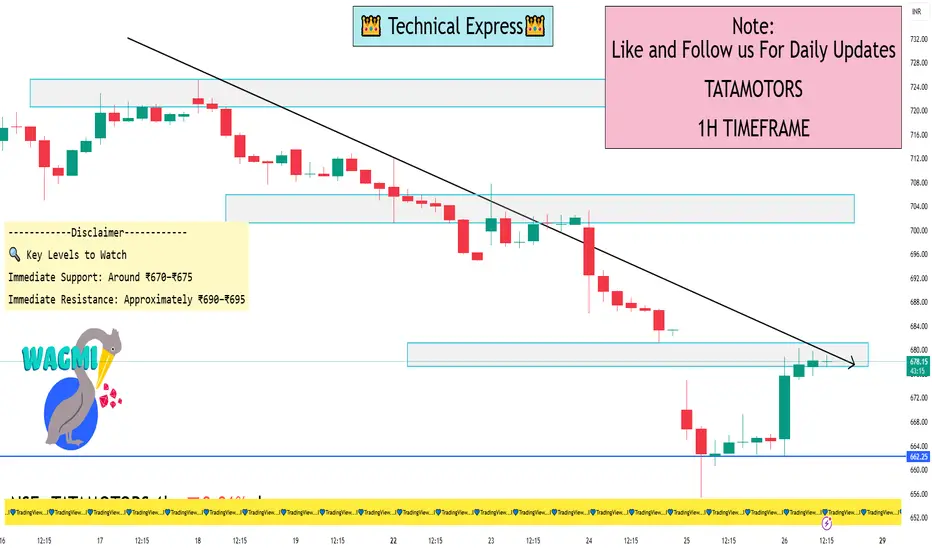

On the 1-hour chart, Tata Motors exhibits a neutral trend, indicating indecision in the short term. Key technical indicators are as follows:

Relative Strength Index (RSI): Approximately 50, suggesting balanced buying and selling pressures.

Moving Averages: The stock is trading near its short-term moving averages, with no clear bullish or bearish crossover.

Volume: Trading volume is consistent with recent averages, showing no significant spikes.

Given these indicators, the stock is consolidating within a range, awaiting a catalyst for a directional move.

🔍 Key Levels to Watch

Immediate Support: Around ₹670–₹675. A breakdown below this level could lead to a retest of ₹650.

Immediate Resistance: Approximately ₹690–₹695. A breakout above this zone may target ₹720–₹730.

⚠️ Market Context

The recent uptick follows a challenging period marked by a cyberattack at Jaguar Land Rover, which had a significant financial impact. While operations are resuming, the stock remains sensitive to further developments.

Relative Strength Index (RSI): Approximately 50, suggesting balanced buying and selling pressures.

Moving Averages: The stock is trading near its short-term moving averages, with no clear bullish or bearish crossover.

Volume: Trading volume is consistent with recent averages, showing no significant spikes.

Given these indicators, the stock is consolidating within a range, awaiting a catalyst for a directional move.

🔍 Key Levels to Watch

Immediate Support: Around ₹670–₹675. A breakdown below this level could lead to a retest of ₹650.

Immediate Resistance: Approximately ₹690–₹695. A breakout above this zone may target ₹720–₹730.

⚠️ Market Context

The recent uptick follows a challenging period marked by a cyberattack at Jaguar Land Rover, which had a significant financial impact. While operations are resuming, the stock remains sensitive to further developments.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。