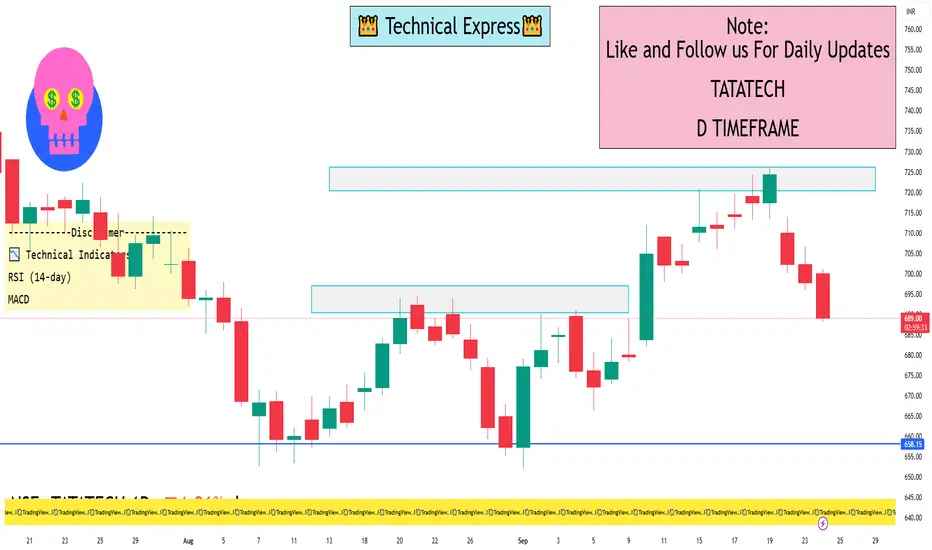

📊 1-Day Technical Analysis

📈 Support and Resistance Levels

Immediate Support: ₹693.90

Immediate Resistance: ₹704.95

📉 Moving Averages

5-Day Moving Average: ₹696.90 (indicating a short-term bearish trend)

50-Day Moving Average: ₹710.72 (suggesting a bearish outlook)

200-Day Moving Average: ₹688.48 (indicating a long-term bullish trend)

📉 RSI (Relative Strength Index)

14-Day RSI: 33.53 (below 35, indicating an oversold condition and potential for a rebound)

📉 MACD (Moving Average Convergence Divergence)

MACD Value: -4.46 (below zero, confirming a bearish trend)

🔄 Overall Technical Indicators

Short-Term Outlook: Bearish

Medium-Term Outlook: Neutral

Long-Term Outlook: Bullish

🔮 Short-Term Forecast

The stock is expected to trade within a range of ₹690.89 to ₹704.61 on September 24, 2025, based on the 14-day Average True Range (ATR)

✅ Summary

Currently, Tata Technologies Ltd. exhibits a bearish short-term trend with potential for a rebound due to oversold conditions. Investors may consider monitoring for signs of stabilization or reversal before making trading decisions.

📈 Support and Resistance Levels

Immediate Support: ₹693.90

Immediate Resistance: ₹704.95

📉 Moving Averages

5-Day Moving Average: ₹696.90 (indicating a short-term bearish trend)

50-Day Moving Average: ₹710.72 (suggesting a bearish outlook)

200-Day Moving Average: ₹688.48 (indicating a long-term bullish trend)

📉 RSI (Relative Strength Index)

14-Day RSI: 33.53 (below 35, indicating an oversold condition and potential for a rebound)

📉 MACD (Moving Average Convergence Divergence)

MACD Value: -4.46 (below zero, confirming a bearish trend)

🔄 Overall Technical Indicators

Short-Term Outlook: Bearish

Medium-Term Outlook: Neutral

Long-Term Outlook: Bullish

🔮 Short-Term Forecast

The stock is expected to trade within a range of ₹690.89 to ₹704.61 on September 24, 2025, based on the 14-day Average True Range (ATR)

✅ Summary

Currently, Tata Technologies Ltd. exhibits a bearish short-term trend with potential for a rebound due to oversold conditions. Investors may consider monitoring for signs of stabilization or reversal before making trading decisions.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。