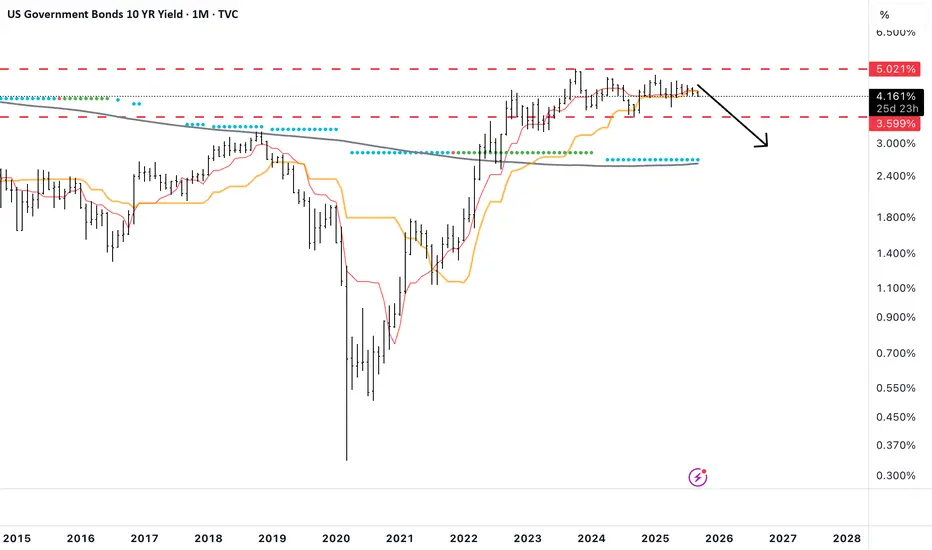

Everyone keeps talking about how rates cuts are going to push long term yields higher because that is what happened last September, etc, etc.

IMO the bond market is realizing that the US Economy is already in a very weak state and it will adjust accordingly.

It's highly doubtful that rates will "crash" but the 10 year could hit 2.5-2.7% (near the 200 SMA) and it would still be in an overall long term bullish structure.

IMO the bond market is realizing that the US Economy is already in a very weak state and it will adjust accordingly.

It's highly doubtful that rates will "crash" but the 10 year could hit 2.5-2.7% (near the 200 SMA) and it would still be in an overall long term bullish structure.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。