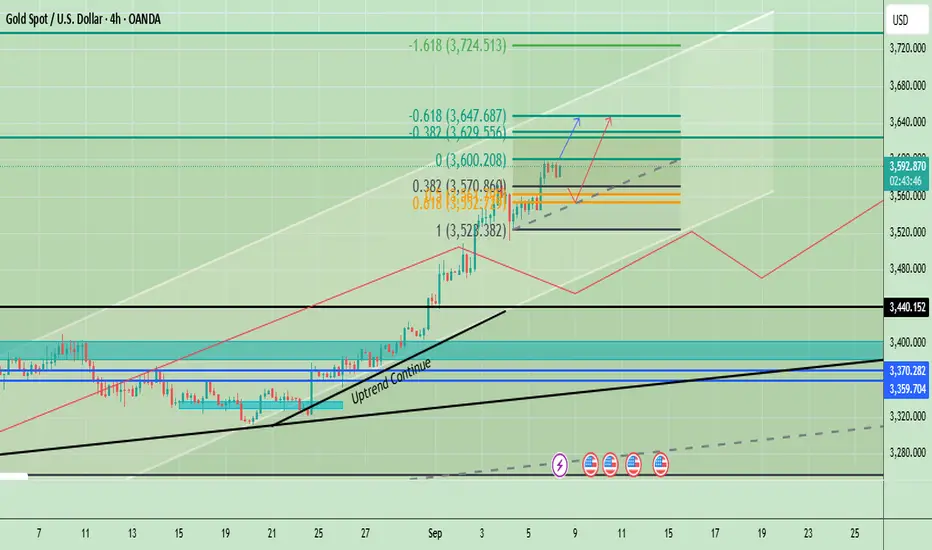

Gold is consolidating just below the $3,600 resistance zone, which is a critical pivot. The uptrend structure remains intact, and short-term retracements into the $3,570–$3,552 zone can provide a strong buy opportunity. A decisive break above $3,600 would trigger further bullish momentum toward $3,629, $3,647, and potentially $3,724. On the downside, a daily close below $3,528 would weaken momentum, while a drop under $3,440 would signal trend exhaustion.

Macro fundamentals support this bullish bias: weak U.S. labor data has boosted expectations for Fed rate cuts in September, while the upcoming CPI release on September 11 will be the key event. Softer CPI would confirm easing conditions and strengthen gold’s rally, while a hotter CPI could trigger a short-term pullback into support.

🔑 Key Levels

- Immediate Resistance: $3,600, $3,629 – $3,647

- Support / Buy Zone: $3,570 – $3,552, $3,528 (structural swing low support).

✅ Best Setup:

- Buy Zone: $3,570–$3,552

- Buy Trigger: Bounce from support or breakout above $3,600

- Upside Targets: $3,629 → $3,647 → $3,724

- Invalidation: Below $3,528

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Macro fundamentals support this bullish bias: weak U.S. labor data has boosted expectations for Fed rate cuts in September, while the upcoming CPI release on September 11 will be the key event. Softer CPI would confirm easing conditions and strengthen gold’s rally, while a hotter CPI could trigger a short-term pullback into support.

🔑 Key Levels

- Immediate Resistance: $3,600, $3,629 – $3,647

- Support / Buy Zone: $3,570 – $3,552, $3,528 (structural swing low support).

✅ Best Setup:

- Buy Zone: $3,570–$3,552

- Buy Trigger: Bounce from support or breakout above $3,600

- Upside Targets: $3,629 → $3,647 → $3,724

- Invalidation: Below $3,528

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

トレード稼働中

gold has broken out of the triangle consolidation above $3,600, confirming bullish continuation. This breakout confirms bullish momentum, with upside targets at $3,629 and $3,647 in the short term. The buy zone support remains at $3,570–$3,552, which now acts as a retest area if price pulls back. As long as gold holds above $3,570, the bullish structure stays intact, keeping focus on higher targets.

トレード終了: 利益確定目標に到達

Target achieved successfully$47=470 Pips Booked ($3600-$3,647 Target)

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。