🔍 Technical Breakdown:

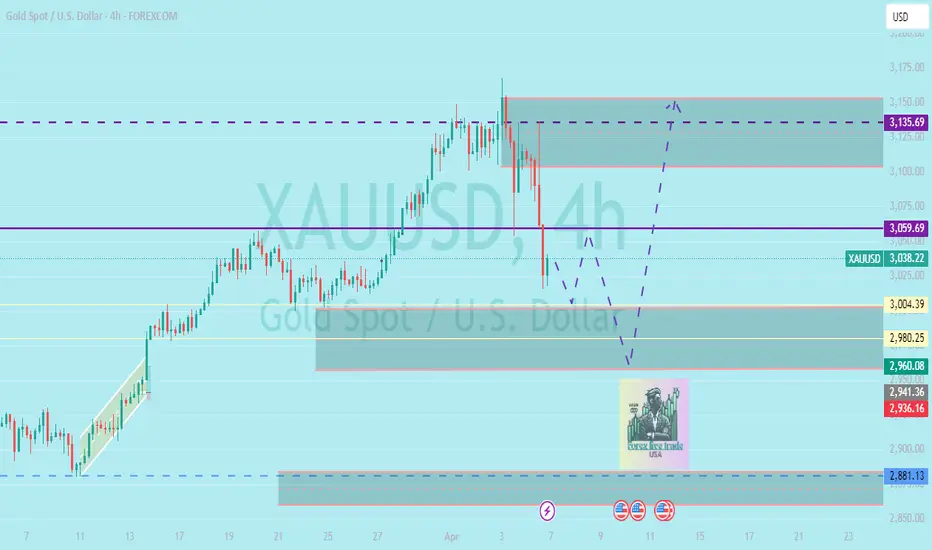

Gold (XAUUSD) has recently shown signs of weakness after rejecting the major supply zone near $3,135, followed by a sharp sell-off breaking through mid-range support around $3,059.

📉 Price Action Summary:

After printing a swing high around $3,135, price formed a distribution range with lower highs indicating selling pressure.

A strong bearish candle broke structure and pushed price below $3,059, confirming a short-term shift in market sentiment.

Price is now hovering around a high-probability demand zone between $3,004 and $2,980, where past accumulation was observed.

📈 Key Zones to Watch:

🔻 Support / Demand Zones:

$3,004 – $2,980: Key intraday demand zone, where buyers may step in.

$2,960 – $2,936: Additional support; if broken, opens up a path to:

$2,881: Weekly demand zone; potential for major reversal or bounce.

🔺 Resistance / Supply Zones:

$3,059: Previous structure support, now turned resistance.

$3,135: Higher time frame supply zone where price faced strong rejection.

$3,175 – $3,200: Weekly targets if bullish reversal plays out.

🧠 Fundamental Outlook (April 8–12, 2025):

This week is event-heavy, especially for the USD:

🔥 Key Events:

April 10 (Wednesday): 🔴 US CPI Data

A hot CPI print = Fed may stay hawkish → bearish for gold.

A soft CPI = weakening USD → bullish for gold.

April 11 (Thursday): 🟡 US PPI & Unemployment Claims

Could confirm or contradict CPI direction.

April 12 (Friday): 🟡 FOMC Member Speeches

Watch tone: Hawkish = USD strength; dovish = gold upside.

Gold (XAUUSD) has recently shown signs of weakness after rejecting the major supply zone near $3,135, followed by a sharp sell-off breaking through mid-range support around $3,059.

📉 Price Action Summary:

After printing a swing high around $3,135, price formed a distribution range with lower highs indicating selling pressure.

A strong bearish candle broke structure and pushed price below $3,059, confirming a short-term shift in market sentiment.

Price is now hovering around a high-probability demand zone between $3,004 and $2,980, where past accumulation was observed.

📈 Key Zones to Watch:

🔻 Support / Demand Zones:

$3,004 – $2,980: Key intraday demand zone, where buyers may step in.

$2,960 – $2,936: Additional support; if broken, opens up a path to:

$2,881: Weekly demand zone; potential for major reversal or bounce.

🔺 Resistance / Supply Zones:

$3,059: Previous structure support, now turned resistance.

$3,135: Higher time frame supply zone where price faced strong rejection.

$3,175 – $3,200: Weekly targets if bullish reversal plays out.

🧠 Fundamental Outlook (April 8–12, 2025):

This week is event-heavy, especially for the USD:

🔥 Key Events:

April 10 (Wednesday): 🔴 US CPI Data

A hot CPI print = Fed may stay hawkish → bearish for gold.

A soft CPI = weakening USD → bullish for gold.

April 11 (Thursday): 🟡 US PPI & Unemployment Claims

Could confirm or contradict CPI direction.

April 12 (Friday): 🟡 FOMC Member Speeches

Watch tone: Hawkish = USD strength; dovish = gold upside.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。