Ticker: XBIO

Float: ~1.25 M shares

Volume: ≈ 5.5 M shares → 4.4× float rotation

Dollar Volume: ≈ 59 M USD

Move: +266 % today

Type: Parabolic microfloat blow-off

🧩 Thesis

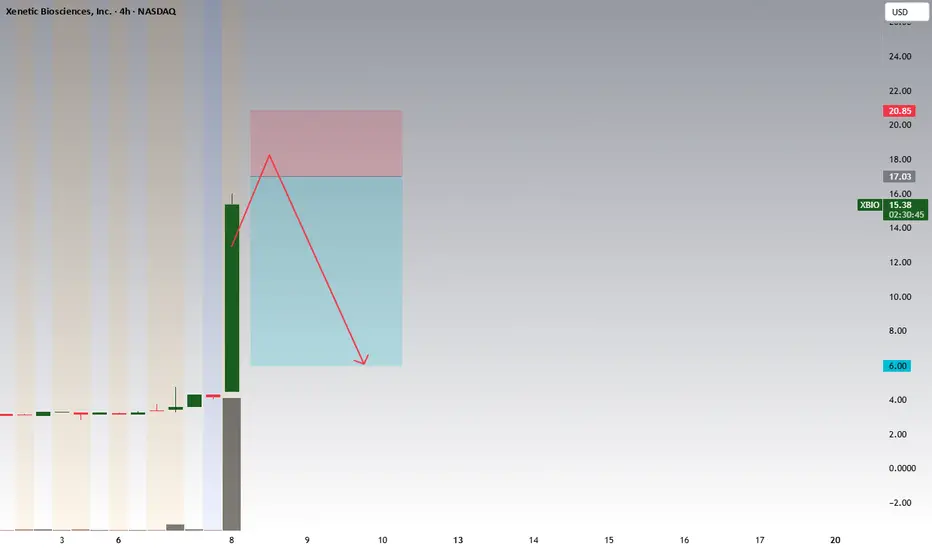

XBIO completed a full-float rotation and printed a parabolic move — the kind of setup that often signals retail exhaustion.

Now the chart is forming the first red daily close (FRD) after a multi-hundred-percent run, marking the shift from euphoria to distribution.

This is a textbook Steven Dux FRD short setup — high liquidity, over-rotation, and the first confirmed daily weakness.

🔑 Key Levels

$20.80 – $21.00: Parabolic top / max risk zone

$17.00: Failed lower-high area / short entry trigger

$10.00: VWAP zone and mid-range target

$6.00: Pre-run base and final target

🎯 Trading Plan

FRD Short (Active Setup)

Daily candle closes red after extreme green run.

Look for an intraday lower high below $17.00 confirming backside formation.

Entry: Short on the break of $14–13.5 after the lower-high rejection.

Risk: Hard stop above $21.00 (previous day’s top).

Targets:

T1 → $11.00 (cover 30–50 %)

T2 → $8.00–$7.50

T3 → $6.00 (full fade target)

⚠️ Risk Notes

Microfloat = high halt risk. Keep sizing small and avoid chasing.

Confirmation is key: only short after the daily close is red.

If XBIO reclaims $17.50–18.00 with volume → invalidate the setup and stand aside.

🧭 Summary

XBIO rotated more than four times its float, hit +266 %, and is now printing the first red daily close — a classic blow-off exhaustion pattern.

If the weakness continues tomorrow, the FRD short toward $6–8 offers an A+ risk-reward setup.

(This plan is for educational purposes only, not financial advice.)

Float: ~1.25 M shares

Volume: ≈ 5.5 M shares → 4.4× float rotation

Dollar Volume: ≈ 59 M USD

Move: +266 % today

Type: Parabolic microfloat blow-off

🧩 Thesis

XBIO completed a full-float rotation and printed a parabolic move — the kind of setup that often signals retail exhaustion.

Now the chart is forming the first red daily close (FRD) after a multi-hundred-percent run, marking the shift from euphoria to distribution.

This is a textbook Steven Dux FRD short setup — high liquidity, over-rotation, and the first confirmed daily weakness.

🔑 Key Levels

$20.80 – $21.00: Parabolic top / max risk zone

$17.00: Failed lower-high area / short entry trigger

$10.00: VWAP zone and mid-range target

$6.00: Pre-run base and final target

🎯 Trading Plan

FRD Short (Active Setup)

Daily candle closes red after extreme green run.

Look for an intraday lower high below $17.00 confirming backside formation.

Entry: Short on the break of $14–13.5 after the lower-high rejection.

Risk: Hard stop above $21.00 (previous day’s top).

Targets:

T1 → $11.00 (cover 30–50 %)

T2 → $8.00–$7.50

T3 → $6.00 (full fade target)

⚠️ Risk Notes

Microfloat = high halt risk. Keep sizing small and avoid chasing.

Confirmation is key: only short after the daily close is red.

If XBIO reclaims $17.50–18.00 with volume → invalidate the setup and stand aside.

🧭 Summary

XBIO rotated more than four times its float, hit +266 %, and is now printing the first red daily close — a classic blow-off exhaustion pattern.

If the weakness continues tomorrow, the FRD short toward $6–8 offers an A+ risk-reward setup.

(This plan is for educational purposes only, not financial advice.)

Do not have 30K followers, do not have to share 15 trade a day, because you pay subscription, do not live from subscription, but sharing my knowledge trades and signals. For free. If you want to join, you are welcomed. t.me/+CE3Vdc5m72w4MjRk

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Do not have 30K followers, do not have to share 15 trade a day, because you pay subscription, do not live from subscription, but sharing my knowledge trades and signals. For free. If you want to join, you are welcomed. t.me/+CE3Vdc5m72w4MjRk

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。