INVITE-ONLY SCRIPT

Omega Indicator

アップデート済

The Omega Trend and Signal indicator is a toolkit designed to help both experienced and new traders with their trading decisions.

This indicator is a part of the omega toolkit, and his creation method is based on the concept that every trading strategy should have a way to determine the trend, or the bias, that answers the question “long or short?”; the location, which identifies the best price level to enter into a position and to exit, both in profit and in loss, and that will decide the final risk-to-reward ratio of the trade you take; the signal, which is useful to determine the best moment to enter into a position and that if paired with the trend point, his purpose is to identify when the large trend picture is in confluence with the small term; and last but not least the filter point, the filter is used to have another way to have an additional confluence with the trade you want to take, and it’s important to reduce the number of false signals and to increase the win rate.

This tool aims to help traders with the identification of the trend and the signal points, based on a large number of different formula that works combined to display the final output. It’s important to note that indicator and technical analysis is only one of the several different ways to analyze an asset.

One of the main things to keep in mind when working with the financial markets is that not every asset, every historical phase, and every market condition is the same, this is why this tool can be highly personalized and adjustable and provide different overlay tools in order to allow traders to choose the best settings considering this variable and your backtests.

This tool, thanks to the previously cited characteristics, can work on any market and any horizontal time frame, and it has different features:

- Both Trends following and Mean Reversal usage: with different trend detection and signal formulas (not to be followed blindly like any other indicator or trading method).

- Minimalistic usage: with easy-to-enable functions both functionally and aesthetically, to keep your charts clean and to give you the power to choose only what you want to use this indicator for.

- Candle coloring: the easiest way to identify the trend current situation based on the technical formula, with the color you have chosen, and with 5 different variations: strong sell, sell (same color of strong sell but less opacity), neutral, buy, strong buy (same color of buy with more opacity).

- Automatic signal coloring, that will change the way the signals are visualized based on the mid-term trend condition, giving you both entry and exit suggested signals.

- Trend signals: an option that will display the signal based on the same algorithm that works for the candle coloring, but visualizing only the most significant trend changes

- Signal filters, that works differently for trend following and for mean reversal settings, and are divided into three different categories: additional filters remove the repetitive signals in the trend following usage and the low volume signals in the mean reversal usage; location filter remove the signal that is over/below the current trend fair value, giving you only premium or discount signal based on the direction of the trade; and the confluence filter, that for trend following usage filter out signal not in confluence with the Trend cloud overlay indicator and for mean reversal keeps only the signal that is at least in the first band of the Extreme zones overlay indicator.

- Signal sensitivity optimization with the “Fast length” parameter, with base value “1” you can choose the multiplier for that parameter.

- Trend detection optimization with the “Slow length” parameter, with base value “1” you can choose the multiplier for that parameter.

- Overlay indicator optimization with the “Trend length” parameter, with base value “1” you can choose the multiplier for that parameter.

- 4 Overlay indicator to keep the analysis simple and to assist traders to see the trend clearer and identifying the best zones and conditions to enter a trade.

- The option to visualize as numbers that go from 0 to 10 the current trend strength based on the settings to want to use and calculated with the historical best number that has been displayed (it’s shown under the last candles, only if you have selected the trend following or the mean reversal settings).

- Automatic alerts for Buy and Sell signals based on the settings and the filter that you have chosen.

- The option to show only some parts of the indicator, such as the signals or the candle coloring.

- Heikin Ashi: a modified and more simple version of the classic Heikin Ashi candle that is not realistic on the market when used improperly. This option enables the overlay of the candle with the same high, low, and close of the original candle, but the open is the average of the previous open and the previous close.

The signals work this way: if the script has detected a buy signal if the current trend strength is in confluence with the signal, you’ll see a colored dot under the candle (or over if it’s sell), but if the signal is not in confluence, you’ll see a gray (or the color you have chosen for neutral color settings) mark in the same location, so under the candle, if it’s a buy signal not supported by the trend and over the candle if it’s a sell signals not in confluence with the trend parameters, and in this cases the signals aim to suggest to close your open opposite position. This works both for Trend following and for Mean reversal usage.

In this image, there are enable the Adaptive Zone and the Extreme Zones overlay indicators, with the Mean Reversal candle coloring and signal usage.

As you can see, the Extreme Zones are designed to give with a complex script the zones in which the price is likely to reverse, of course depending on the market condition and asset.

The Adaptive Zone is a modified version of the popular super trend indicator, and is designed to work in a different way: instead of giving a buy and sell signal at the switch of the direction, this tool gives its best when used as an area of support and resistance to enter a trade with a bigger risk to reward ratio.

In these other photos, you can see the Trend Midline and the Trend Cloud overlay indicators, with the Trend Following candle coloring and signal usage.

The Trend Midline is a powerful tool that includes different calculations inside and can work like a moving average to identify the level of support and resistance, take profit and stop loss. In addition to that, the Trend Midline overlay indicator is colored based on a large number of different indicators that display the final output as colors, this way, whenever the indicator is colored as the positive color (blue by default) you’ll have another confirmation that the trend is bullish, and vice versa.

The Trend Cloud is a modified version of the popular Ichimoku Kumo, created to help traders identify the trend direction the best. Another great way to use this tool is to mark a horizontal line at the price level in which the two lines of the indicator have switched in position to identify potential future levels of support and resistance.

Risk Disclaimer:

All content and scripts provided are purely for informational & educational purposes only and do not constitute financial advice or a solicitation to buy or sell any securities of any type. Past performance does not guarantee future results. Trading can lead to a loss of the invested capital in the financial markets. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

This indicator is a part of the omega toolkit, and his creation method is based on the concept that every trading strategy should have a way to determine the trend, or the bias, that answers the question “long or short?”; the location, which identifies the best price level to enter into a position and to exit, both in profit and in loss, and that will decide the final risk-to-reward ratio of the trade you take; the signal, which is useful to determine the best moment to enter into a position and that if paired with the trend point, his purpose is to identify when the large trend picture is in confluence with the small term; and last but not least the filter point, the filter is used to have another way to have an additional confluence with the trade you want to take, and it’s important to reduce the number of false signals and to increase the win rate.

This tool aims to help traders with the identification of the trend and the signal points, based on a large number of different formula that works combined to display the final output. It’s important to note that indicator and technical analysis is only one of the several different ways to analyze an asset.

One of the main things to keep in mind when working with the financial markets is that not every asset, every historical phase, and every market condition is the same, this is why this tool can be highly personalized and adjustable and provide different overlay tools in order to allow traders to choose the best settings considering this variable and your backtests.

This tool, thanks to the previously cited characteristics, can work on any market and any horizontal time frame, and it has different features:

- Both Trends following and Mean Reversal usage: with different trend detection and signal formulas (not to be followed blindly like any other indicator or trading method).

- Minimalistic usage: with easy-to-enable functions both functionally and aesthetically, to keep your charts clean and to give you the power to choose only what you want to use this indicator for.

- Candle coloring: the easiest way to identify the trend current situation based on the technical formula, with the color you have chosen, and with 5 different variations: strong sell, sell (same color of strong sell but less opacity), neutral, buy, strong buy (same color of buy with more opacity).

- Automatic signal coloring, that will change the way the signals are visualized based on the mid-term trend condition, giving you both entry and exit suggested signals.

- Trend signals: an option that will display the signal based on the same algorithm that works for the candle coloring, but visualizing only the most significant trend changes

- Signal filters, that works differently for trend following and for mean reversal settings, and are divided into three different categories: additional filters remove the repetitive signals in the trend following usage and the low volume signals in the mean reversal usage; location filter remove the signal that is over/below the current trend fair value, giving you only premium or discount signal based on the direction of the trade; and the confluence filter, that for trend following usage filter out signal not in confluence with the Trend cloud overlay indicator and for mean reversal keeps only the signal that is at least in the first band of the Extreme zones overlay indicator.

- Signal sensitivity optimization with the “Fast length” parameter, with base value “1” you can choose the multiplier for that parameter.

- Trend detection optimization with the “Slow length” parameter, with base value “1” you can choose the multiplier for that parameter.

- Overlay indicator optimization with the “Trend length” parameter, with base value “1” you can choose the multiplier for that parameter.

- 4 Overlay indicator to keep the analysis simple and to assist traders to see the trend clearer and identifying the best zones and conditions to enter a trade.

- The option to visualize as numbers that go from 0 to 10 the current trend strength based on the settings to want to use and calculated with the historical best number that has been displayed (it’s shown under the last candles, only if you have selected the trend following or the mean reversal settings).

- Automatic alerts for Buy and Sell signals based on the settings and the filter that you have chosen.

- The option to show only some parts of the indicator, such as the signals or the candle coloring.

- Heikin Ashi: a modified and more simple version of the classic Heikin Ashi candle that is not realistic on the market when used improperly. This option enables the overlay of the candle with the same high, low, and close of the original candle, but the open is the average of the previous open and the previous close.

The signals work this way: if the script has detected a buy signal if the current trend strength is in confluence with the signal, you’ll see a colored dot under the candle (or over if it’s sell), but if the signal is not in confluence, you’ll see a gray (or the color you have chosen for neutral color settings) mark in the same location, so under the candle, if it’s a buy signal not supported by the trend and over the candle if it’s a sell signals not in confluence with the trend parameters, and in this cases the signals aim to suggest to close your open opposite position. This works both for Trend following and for Mean reversal usage.

In this image, there are enable the Adaptive Zone and the Extreme Zones overlay indicators, with the Mean Reversal candle coloring and signal usage.

As you can see, the Extreme Zones are designed to give with a complex script the zones in which the price is likely to reverse, of course depending on the market condition and asset.

The Adaptive Zone is a modified version of the popular super trend indicator, and is designed to work in a different way: instead of giving a buy and sell signal at the switch of the direction, this tool gives its best when used as an area of support and resistance to enter a trade with a bigger risk to reward ratio.

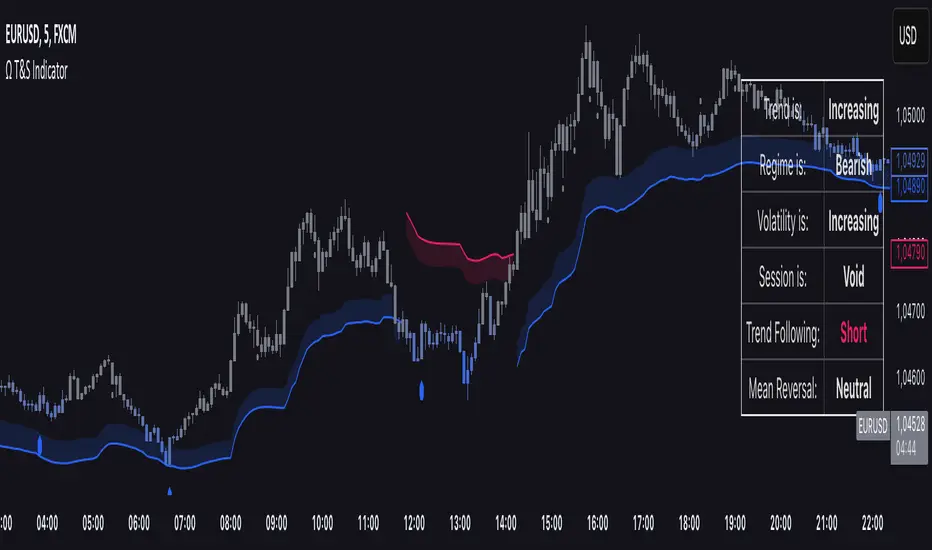

In these other photos, you can see the Trend Midline and the Trend Cloud overlay indicators, with the Trend Following candle coloring and signal usage.

The Trend Midline is a powerful tool that includes different calculations inside and can work like a moving average to identify the level of support and resistance, take profit and stop loss. In addition to that, the Trend Midline overlay indicator is colored based on a large number of different indicators that display the final output as colors, this way, whenever the indicator is colored as the positive color (blue by default) you’ll have another confirmation that the trend is bullish, and vice versa.

The Trend Cloud is a modified version of the popular Ichimoku Kumo, created to help traders identify the trend direction the best. Another great way to use this tool is to mark a horizontal line at the price level in which the two lines of the indicator have switched in position to identify potential future levels of support and resistance.

Risk Disclaimer:

All content and scripts provided are purely for informational & educational purposes only and do not constitute financial advice or a solicitation to buy or sell any securities of any type. Past performance does not guarantee future results. Trading can lead to a loss of the invested capital in the financial markets. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

リリースノート

Multiple bug fixes.Improved the formula for the Trend Midline and the Trend Cloud overlay indicators.

Improved the formula for the candle coloring.

Improved the formula for the entry and exit signals.

リリースノート

Settings aesthetics changing.The option to display a modified version of the Heikin Ashi candle (same high, low, and close as a real candle, the open is the average between the previous open and close) has been implemented.

The signals formula has been changed and the settings adjusted.

リリースノート

Slightly improvements in the candle coloring and trend formula.Introduction to the Adapt signals formula setting: an option to change the formula that identifies the signals to be less specific and more long-range focused.

リリースノート

General script improvements for the long trend signalsリリースノート

Script formula improvementsリリースノート

Script formula improvements.リリースノート

Bug fixesリリースノート

Added the MTF Table: a new function to display the current trend direction, based on the settings you have chosen, on 4 different timeframes.リリースノート

Overlay Indicators formula adjustmentsリリースノート

Aesthetic changes in the overlay indicatorsリリースノート

Added the gradient candle coloring optionリリースノート

Improved overlay indicatorsリリースノート

Script efficiency improvedリリースノート

New Overlay indicator added: Breakout channelリリースノート

Script indicators overlay formula optimizationリリースノート

Major Update:1. Re-adapted the trend detection formula both for trend following and mean reversal

2. Recreated the signal mode: now you can choose between 4 different signal formulas to use both for trend following and mean reversal trend detection

3. Added the toggle mode for the gradient candle coloring both for the candle coloring and some overlay indicators

4. Added the gradient candle coloring method to the Heikin Ashi candle

5. Made the script lighter

6. Removal of additional signals filter and the trend detection signals

7. Improved the signal formulas

リリースノート

Signals filter added:1. Volume filter: remove signals with low volume

2. Location filter: remove signals that are not discount or premium

3. Repetition filter: remove consecutive equals signals

リリースノート

Script settings adjustmentsリリースノート

Script formula adjustmentsリリースノート

Script formula adjustmentsリリースノート

Minor aesthetics changesリリースノート

New signal mode: Liquidity Grabsリリースノート

Script formula implementationsリリースノート

Script minor adjustmentsリリースノート

Signals now can be displayed even without the trend detecting activeリリースノート

Alert for trend change addedリリースノート

New Version:- Signals are now automatic considering the trend detection method used

- New functions have been added to calculations to give better results

- General efficiency improvement

リリースノート

Mean reverting formula reworkedリリースノート

Backtest Value added招待専用スクリプト

このスクリプトへのアクセスは作者が許可したユーザーに制限されており、通常はお支払いが必要です。お気に入りに追加することはできますが、許可を申請して作者が許可した後でなければ使用することはできません。 詳細については OmegaTools にお問い合わせいただくか、以下の作者の指示に従ってください。

スクリプトの動作を理解していて作者も100%信頼できるということでなければ、TradingViewとしてはお金を払ってまでスクリプトを利用するのはお勧めしません。そのかわりに、コミュニティスクリプトでオープンソースの優れたスクリプトが無料で見つけられることが多々あります。

作者の指示

″To have this and other custom indicators go on https://www.patreon.com/omegatools/membership

チャートでこのスクリプトを利用したいですか?

注: アクセス権をリクエストされる前にこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。