INVITE-ONLY SCRIPT

SN30 Indicator

アップデート済

Indicator «SN30»

Class: oscillator

Trading type: scalping

Time frame: 5 min

Purpose: reversal trading

Level of aggressiveness: standard

Indicator «SN30» is based on the linier regression and normal distribution. Regression is one of the most popular and effective methods of the time series analysis and data prediction. Indicator «SN30» uses regression analysis as an alternative to the moving averages analysis. The main aim is data series smoothing to reduce the noise in data. It allows to see market as it is, without deformation.

Using unique author algorithm indicator «SN30» searches for the optimal buy/sell zones. If they are sufficient indicator generates appropriate trading signals.

Structure of the indicator «SN30»

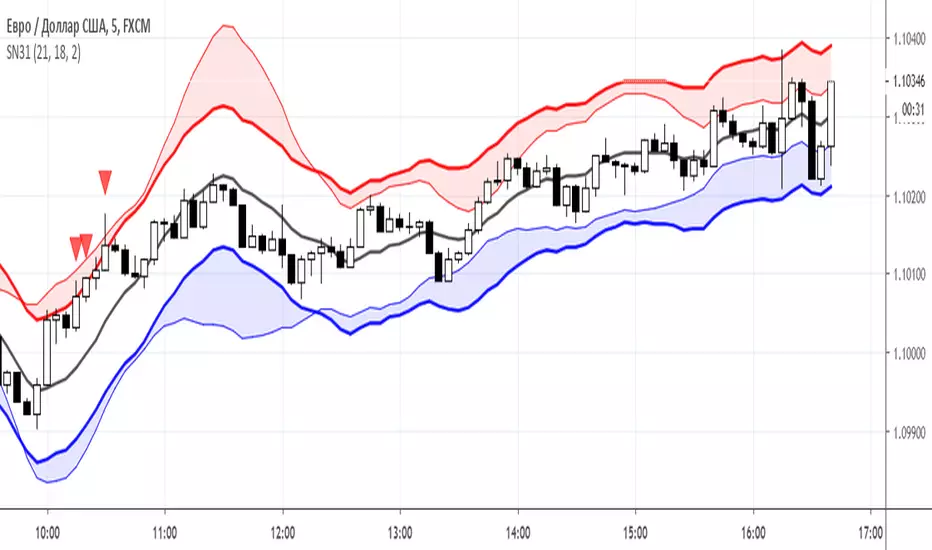

Indicator «SN30» consists of central channel line (green line based on linier regression) and price channels (2 blue and 2 red lines with colored zones between them). Colored zones are of two types: red (overbought zone) and blue (oversold zone). They are used to define deviations of the current prices from their fair values. When the price enters the red zone it should reverse soon (the prices will go down). The same is true for the blue zone (the prices will go up).

Also when the buy/sell signal is generated special signs are displayed on the chart (red and blue triangles)

Parameters of the «SN30» indicator

1. PeriodSN30 (indicator period, default value = 21) – is used to calculate fair value of the asset based on linier regression.

2. Width – defines the width of the stationary channel (indicated by bold lines). Default value = 20 pips.

3. Sigma – defines the width of the dynamic channel (indicated by usual lines). Default value = 2standard deviations. It allows fitting 95% of price values into channel. All the price values out of the channel are treated as abnormal.

Rules of trading

The indicator is designed to work on 5-minute time frames, but after additional adjustment of parameters it can be used on any other time periods.

The general principle of the “SN30” indicator is the same as that of any indicator of the oscillatory class: when the price is in the overbought zone it is interpreted as a signal of a future price reverse in the downward direction, and when the price is in the oversold zone it is a signal of a future price reverse in the upward direction.

The rules of trading are extremely simple: when the red triangle is appeared on the chart (sell signal) or a blue triangle (a buy signal), a corresponding transaction (sell or buy an asset) should be done. Stops can be placed above/below the red/blue zones.

Class: oscillator

Trading type: scalping

Time frame: 5 min

Purpose: reversal trading

Level of aggressiveness: standard

Indicator «SN30» is based on the linier regression and normal distribution. Regression is one of the most popular and effective methods of the time series analysis and data prediction. Indicator «SN30» uses regression analysis as an alternative to the moving averages analysis. The main aim is data series smoothing to reduce the noise in data. It allows to see market as it is, without deformation.

Using unique author algorithm indicator «SN30» searches for the optimal buy/sell zones. If they are sufficient indicator generates appropriate trading signals.

Structure of the indicator «SN30»

Indicator «SN30» consists of central channel line (green line based on linier regression) and price channels (2 blue and 2 red lines with colored zones between them). Colored zones are of two types: red (overbought zone) and blue (oversold zone). They are used to define deviations of the current prices from their fair values. When the price enters the red zone it should reverse soon (the prices will go down). The same is true for the blue zone (the prices will go up).

Also when the buy/sell signal is generated special signs are displayed on the chart (red and blue triangles)

Parameters of the «SN30» indicator

1. PeriodSN30 (indicator period, default value = 21) – is used to calculate fair value of the asset based on linier regression.

2. Width – defines the width of the stationary channel (indicated by bold lines). Default value = 20 pips.

3. Sigma – defines the width of the dynamic channel (indicated by usual lines). Default value = 2standard deviations. It allows fitting 95% of price values into channel. All the price values out of the channel are treated as abnormal.

Rules of trading

The indicator is designed to work on 5-minute time frames, but after additional adjustment of parameters it can be used on any other time periods.

The general principle of the “SN30” indicator is the same as that of any indicator of the oscillatory class: when the price is in the overbought zone it is interpreted as a signal of a future price reverse in the downward direction, and when the price is in the oversold zone it is a signal of a future price reverse in the upward direction.

The rules of trading are extremely simple: when the red triangle is appeared on the chart (sell signal) or a blue triangle (a buy signal), a corresponding transaction (sell or buy an asset) should be done. Stops can be placed above/below the red/blue zones.

リリースノート

Default value of the "width" parameter changed from 20 to 18.Default color of the middle line changed from "green" to "black".

The name of the indicator changed from "SN30" to "SN31".

招待専用スクリプト

このスクリプトへのアクセスは作者が許可したユーザーに制限されており、通常はお支払いが必要です。お気に入りに追加することはできますが、許可を申請して作者が許可した後でなければ使用することはできません。 詳細については Trade24Fx にお問い合わせいただくか、以下の作者の指示に従ってください。

スクリプトの動作を理解していて作者も100%信頼できるということでなければ、TradingViewとしてはお金を払ってまでスクリプトを利用するのはお勧めしません。そのかわりに、コミュニティスクリプトでオープンソースの優れたスクリプトが無料で見つけられることが多々あります。

作者の指示

″

チャートでこのスクリプトを利用したいですか?

注: アクセス権をリクエストされる前にこちらをご覧ください。

Авторские индикаторы

bit.ly/2oBvkHY

Больше информации на нашем ютьюб-канале

youtube.com/channel/UCYEOurJfasXWyYnrriGwsqQ

bit.ly/2oBvkHY

Больше информации на нашем ютьюб-канале

youtube.com/channel/UCYEOurJfasXWyYnrriGwsqQ

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。