シャンデ・モメンタム・オシレーター(CMO)

The Savitzky-Golay Filtered Chande Momentum Oscillator (SGCMO) is a modified version of the Chande Momentum Oscillator that functions as a powerful analytical tool, capable of detecting trends and mean reversals. By applying a Savitzky-Golay filter to the price data, the oscillator provides enhanced visualization and smoother readings. (credit to © anieri for the...

シャンデ・モメンタム・オシレーター(CMO)

Rev NR of the CMO ATR, with LagF Filtering - Released 12-27-22 by @Hockeydude84 This code takes Chande Momentum Oscillator (CMO), adds a coded ATR option and then filters the result through a Laguerre Filter (LagF) to reduce erroneous signals. This code also has an option for self adjusting alpha on the Lag, via a lookback table and monitoring the price rate of...

Chande Momentum Oscillator with Overbought and Oversold value If it is above 25 then enter the trade and if goes below -25 then exit from the trade

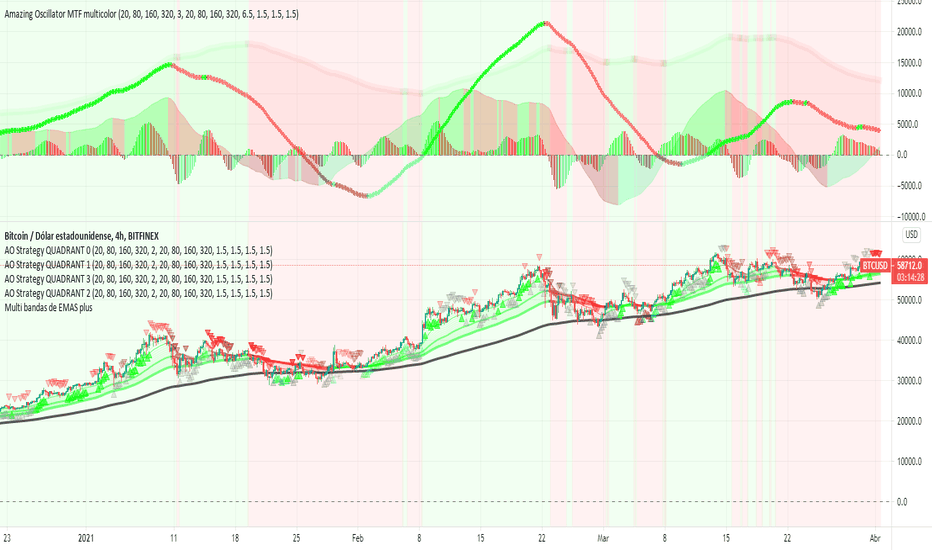

Ingles The amazing multitemporal oscillator, allows you to see in a single graph the Waves that move the market in different temporalities, that is, you will be able to see the market trend, the impulse movement, the forced movement, and the entry and exit points, as well as also how both collide with each other, to understand why the smaller waves succumb to...

Introducing the Caretakers Reverse Chande Momentum Oscillator. The Chande momentum oscillator is a technical momentum indicator which calculates the difference between the sum of recent gains and the sum of recent losses and then divides the result by the sum of all price movement over the same period. It is used to gauge “pure momentum”. It bears similarities...

This is a Chande Momentum strategy that buys and sells when the line crosses the buy and sell lines. Different signal then the other Chande Momentum strategy. In my opinion they both work better at different time frames and possibly commodities.

It seemed weird to me that the default Chande didn't have overbought and oversold regions, despite them being described for Chande Momentum and working very well. So I added the lines and alert conditions. I've used this to very good results in my day trading. My strategy involved 4 timeframes of candlestick, each with 4 timeframes of Chande overlaid....

This applies Chande Momentum to Accumulation and Distribution index as a means to changes. Experimental oscillator. Compare it to both Money Flows, Acc/Dis and Chande and you notice it has elements of all of them. Could potentially replace other volume based momentum indicators in your strategy. It is a little more volatile, reaching from side to side, while...

This is a combination of Lazybears WaveTrend Oscillator (purple line) and Chande Momentum Oscillator (blue line with the orange line as a signal line). Use WaveTrend as a confirmation tool. It is consider as a selling point when CMO is over the red horizontal dotted line. The opposite applies if CMO line is under the red horizontal dotted line. You can also use...

This is a combination of Aroon and Chande Momentum Oscillator . I made a histogram of Aroon , aqua line is Chande Momentum and the orange line are a simple moving average of Chande Momentum as a signal line. One strategy you can use this for is to buy or sell when the signal line crosses the CM line or you can buy and sell when CM line is highest or lowest You...

This study combines two versatile momentum indicators : Chande Momentum Oscillator: -Measures trend strength, with higher absolute values meaning greater strength. -Also tracks divergence. When price increases, but is not accompanied by an increase in Chande Momentum Oscillator values, it signifies bearish divergence and a reversal is likely to follow. -Shown...

StochCMO is the combination of Stochastic and CMO (Chande Momentum Oscillator). The StochCMO is an indicator used in technical analysis that ranges between zero and one and is created by applying the Stochastic Oscillator formula to a set of Chande Momentum Oscillator (CMO) values rather than standard price data. Using CMO values within the Stochastic formula...

Chande Momentum Oscillator script. This indicator was developed and described by Tushar S. Chande and Stanley Kroll in their book "The New Technical Trader" (1994, Chapter 5: New Momentum Oscillators).

The absolute value of "CMO" alone makes it impossible to know the current location for the waves and there is a possibility of doing useless entry. To prevent this, display EMA.

The absolute value of "CMO" alone makes it impossible to know the current location for the waves and there is a possibility of making useless entries. In order to prevent this, display EMA.

This indicator plots a CMO which ignores price changes which are less than a threshold value. CMO was developed by Tushar Chande. A scientist, an inventor, and a respected trading system developer, Mr. Chande developed the CMO to capture what he calls "pure momentum". For more definitive information on the CMO and other indicators we recommend the book The...

This indicator plots a CMO which ignores price changes which are less than a threshold value. CMO was developed by Tushar Chande. A scientist, an inventor, and a respected trading system developer, Mr. Chande developed the CMO to capture what he calls "pure momentum". For more definitive information on the CMO and other indicators we recommend the book...

![Chande Momentum Oscillator + WaveTrend Oscillator [ChuckBanger] BTCUSD: Chande Momentum Oscillator + WaveTrend Oscillator [ChuckBanger]](https://s3.tradingview.com/a/Alxtk5KR_mid.png)

![Aroon Histogram + CMO [ChuckBanger] LTCZ19: Aroon Histogram + CMO [ChuckBanger]](https://s3.tradingview.com/h/hqJGWNKa_mid.png)

![StochCMO - Stochastic CMO [SHK] BTCUSD: StochCMO - Stochastic CMO [SHK]](https://s3.tradingview.com/3/3vVaYQRE_mid.png)