Breaking New Records: Bitcoin's Path Beyond the August Correction

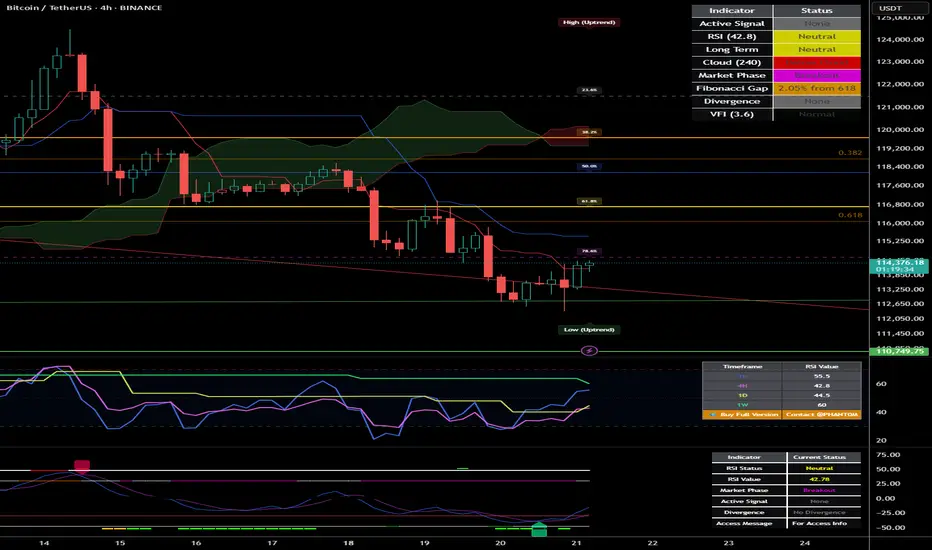

With Bitcoin currently trading at $114,352 after reaching its all-time high of $124,474 on August 14, 2025, we find ourselves at a critical technical juncture. Ill examine Bitcoin's potential trajectory through the remainder of 2025.

Current Market Context

Bitcoin has climbed from around $85,000 in January to establish a new all-time high of $124,474 in mid-August. Following this peak, we've seen a corrective phase with price action forming a potential bull flag pattern between $112,000-$118,000.

The most recent data shows Bitcoin trading around $114,352, representing a pullback of approximately 8.13% from the all-time high. This moderate retracement suggests a healthy reset rather than a reversal of the primary trend.

Ichimoku Cloud Analysis

The Ichimoku Cloud indicators provide critical insights:

• Tenkan-sen: $114,127.92

• Kijun-sen: $115,477.50

• Senkou Span A: $119,324.70

• Senkou Span B: $120,176.36

The price is currently trading below the cloud, indicating short-term bearish sentiment. However, the relatively narrow cloud formation ahead suggests potential for a breakout if Bitcoin can reclaim the $119,324-$120,176 range.

Wyckoff Analysis

The price action following the August peak displays characteristics that align with Wyckoff re-accumulation rather than distribution:

• Initial decline represents a "Preliminary Support" phase

• Trading range between $112,000-$118,000 shows decreasing volatility

• Volume characteristics show diminishing selling pressure

• Recent price action suggests we're approaching the "Spring" phase

This structure indicates institutional accumulation is still occurring at these elevated levels, projecting a move toward the $132,000-$145,000 range in the coming months.

Supply/Demand Zone Analysis

Critical price levels that will influence Bitcoin's next directional move:

• Major demand zone: $114,600-$116,700 (Fibonacci 61.8%-78.6% retracement)

• Secondary support: $111,920-$114,000 (recent low and psychological support)

• Primary resistance: $124,474-$127,889 (all-time high region and 127.2% Fibonacci extension)

Moving Average Analysis

The moving average configuration reveals a strong underlying bullish structure:

• 4H EMA 50: $116,284.41

• 4H EMA 100: $116,781.30

• 4H EMA 200: $116,214.57

• Daily EMA 50: $114,939.55

• Daily EMA 100: $110,513.11

• Daily EMA 200: $103,162.36

The hierarchical alignment of these moving averages confirms the primary bull trend remains intact. The current price is finding support near the Daily EMA 50, a critical level that has historically served as a springboard during bull markets.

Fibonacci Extension Framework

Potential targets using Fibonacci extensions from the recent swing points:

• 127.2% extension: $127,889

• 161.8% extension: $132,232

• 200% extension: $137,028

• 261.8% extension: $144,786

Elliott Wave Analysis

The current price action suggests an extended wave structure:

• Wave 1 high (ATH): $124,474

• Wave 2 low (Recent Low): $111,920

• Wave 3 target range: $144,786 to $157,340

• Wave 4 target: $132,231

• Wave 5 target range: $152,545 to $165,100

This wave count suggests potential for continued appreciation toward the $152,000-$165,000 range before a more significant corrective phase begins.

Bitcoin Dominance Factor

Bitcoin's market dominance currently stands at 59.3%, indicating a strong position relative to the broader cryptocurrency market, providing additional support for the bullish case.

Price Projection Timeline

August-September 2025:

Completion of the current consolidation phase with potential final support tests in the $114,600-$116,700 range. A decisive break above $120,000 would confirm the end of the consolidation phase.

October 2025:

Renewed momentum pushing Bitcoin toward the $127,889-$132,232 range, potentially coinciding with seasonal strength typically observed in Q4.

November-December 2025:

Final wave extension potentially reaching the $144,786-$157,340 range, followed by a Wave 4 correction before the final Wave 5 push toward $152,545-$165,100 by year-end or early 2026.

Key Levels to Monitor

Support Zones:

• Primary: $114,600-$116,700 (Fibonacci retracement zone)

• Secondary: $111,920-$114,000 (recent low and psychological support)

• Tertiary: $103,162-$110,513 (Daily EMA 100-200 zone)

Resistance Zones:

• Immediate: $119,324-$120,176 (Ichimoku Cloud base)

• Secondary: $124,474-$127,889 (all-time high region and 127.2% Fibonacci extension)

• Target 1: $132,232-$137,028 (161.8%-200% Fibonacci extensions)

• Target 2: $144,786-$157,340 (Wave 3 target range)

• Target 3: $152,545-$165,100 (Wave 5 target range)

Strategic Considerations

With Bitcoin having already achieved a new all-time high at $124,474 in August, strategic approaches might include:

• Maintaining core positions while implementing trailing stop strategies

• Adding to positions during retests of key support levels ($114,600-$116,700)

• Considering partial profit-taking at key Fibonacci extension levels

• Remaining vigilant for signs of distribution patterns at higher levels

Conclusion: The Path to $165,000

The weight of technical evidence suggests Bitcoin has entered a new paradigm of price discovery. While the path may include periods of consolidation and volatility, the underlying trend remains firmly bullish with multiple technical frameworks projecting targets in the $152,000-$165,000 range by year-end 2025 or early 2026.

The current correction phase represents a healthy reset rather than a trend reversal, creating an ideal technical foundation for Bitcoin's next major advance. Bitcoin appears well-positioned to achieve new record highs in the coming months.

With Bitcoin currently trading at $114,352 after reaching its all-time high of $124,474 on August 14, 2025, we find ourselves at a critical technical juncture. Ill examine Bitcoin's potential trajectory through the remainder of 2025.

Current Market Context

Bitcoin has climbed from around $85,000 in January to establish a new all-time high of $124,474 in mid-August. Following this peak, we've seen a corrective phase with price action forming a potential bull flag pattern between $112,000-$118,000.

The most recent data shows Bitcoin trading around $114,352, representing a pullback of approximately 8.13% from the all-time high. This moderate retracement suggests a healthy reset rather than a reversal of the primary trend.

Ichimoku Cloud Analysis

The Ichimoku Cloud indicators provide critical insights:

• Tenkan-sen: $114,127.92

• Kijun-sen: $115,477.50

• Senkou Span A: $119,324.70

• Senkou Span B: $120,176.36

The price is currently trading below the cloud, indicating short-term bearish sentiment. However, the relatively narrow cloud formation ahead suggests potential for a breakout if Bitcoin can reclaim the $119,324-$120,176 range.

Wyckoff Analysis

The price action following the August peak displays characteristics that align with Wyckoff re-accumulation rather than distribution:

• Initial decline represents a "Preliminary Support" phase

• Trading range between $112,000-$118,000 shows decreasing volatility

• Volume characteristics show diminishing selling pressure

• Recent price action suggests we're approaching the "Spring" phase

This structure indicates institutional accumulation is still occurring at these elevated levels, projecting a move toward the $132,000-$145,000 range in the coming months.

Supply/Demand Zone Analysis

Critical price levels that will influence Bitcoin's next directional move:

• Major demand zone: $114,600-$116,700 (Fibonacci 61.8%-78.6% retracement)

• Secondary support: $111,920-$114,000 (recent low and psychological support)

• Primary resistance: $124,474-$127,889 (all-time high region and 127.2% Fibonacci extension)

Moving Average Analysis

The moving average configuration reveals a strong underlying bullish structure:

• 4H EMA 50: $116,284.41

• 4H EMA 100: $116,781.30

• 4H EMA 200: $116,214.57

• Daily EMA 50: $114,939.55

• Daily EMA 100: $110,513.11

• Daily EMA 200: $103,162.36

The hierarchical alignment of these moving averages confirms the primary bull trend remains intact. The current price is finding support near the Daily EMA 50, a critical level that has historically served as a springboard during bull markets.

Fibonacci Extension Framework

Potential targets using Fibonacci extensions from the recent swing points:

• 127.2% extension: $127,889

• 161.8% extension: $132,232

• 200% extension: $137,028

• 261.8% extension: $144,786

Elliott Wave Analysis

The current price action suggests an extended wave structure:

• Wave 1 high (ATH): $124,474

• Wave 2 low (Recent Low): $111,920

• Wave 3 target range: $144,786 to $157,340

• Wave 4 target: $132,231

• Wave 5 target range: $152,545 to $165,100

This wave count suggests potential for continued appreciation toward the $152,000-$165,000 range before a more significant corrective phase begins.

Bitcoin Dominance Factor

Bitcoin's market dominance currently stands at 59.3%, indicating a strong position relative to the broader cryptocurrency market, providing additional support for the bullish case.

Price Projection Timeline

August-September 2025:

Completion of the current consolidation phase with potential final support tests in the $114,600-$116,700 range. A decisive break above $120,000 would confirm the end of the consolidation phase.

October 2025:

Renewed momentum pushing Bitcoin toward the $127,889-$132,232 range, potentially coinciding with seasonal strength typically observed in Q4.

November-December 2025:

Final wave extension potentially reaching the $144,786-$157,340 range, followed by a Wave 4 correction before the final Wave 5 push toward $152,545-$165,100 by year-end or early 2026.

Key Levels to Monitor

Support Zones:

• Primary: $114,600-$116,700 (Fibonacci retracement zone)

• Secondary: $111,920-$114,000 (recent low and psychological support)

• Tertiary: $103,162-$110,513 (Daily EMA 100-200 zone)

Resistance Zones:

• Immediate: $119,324-$120,176 (Ichimoku Cloud base)

• Secondary: $124,474-$127,889 (all-time high region and 127.2% Fibonacci extension)

• Target 1: $132,232-$137,028 (161.8%-200% Fibonacci extensions)

• Target 2: $144,786-$157,340 (Wave 3 target range)

• Target 3: $152,545-$165,100 (Wave 5 target range)

Strategic Considerations

With Bitcoin having already achieved a new all-time high at $124,474 in August, strategic approaches might include:

• Maintaining core positions while implementing trailing stop strategies

• Adding to positions during retests of key support levels ($114,600-$116,700)

• Considering partial profit-taking at key Fibonacci extension levels

• Remaining vigilant for signs of distribution patterns at higher levels

Conclusion: The Path to $165,000

The weight of technical evidence suggests Bitcoin has entered a new paradigm of price discovery. While the path may include periods of consolidation and volatility, the underlying trend remains firmly bullish with multiple technical frameworks projecting targets in the $152,000-$165,000 range by year-end 2025 or early 2026.

The current correction phase represents a healthy reset rather than a trend reversal, creating an ideal technical foundation for Bitcoin's next major advance. Bitcoin appears well-positioned to achieve new record highs in the coming months.

Discord.gg/CryptoIndicators

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Discord.gg/CryptoIndicators

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。