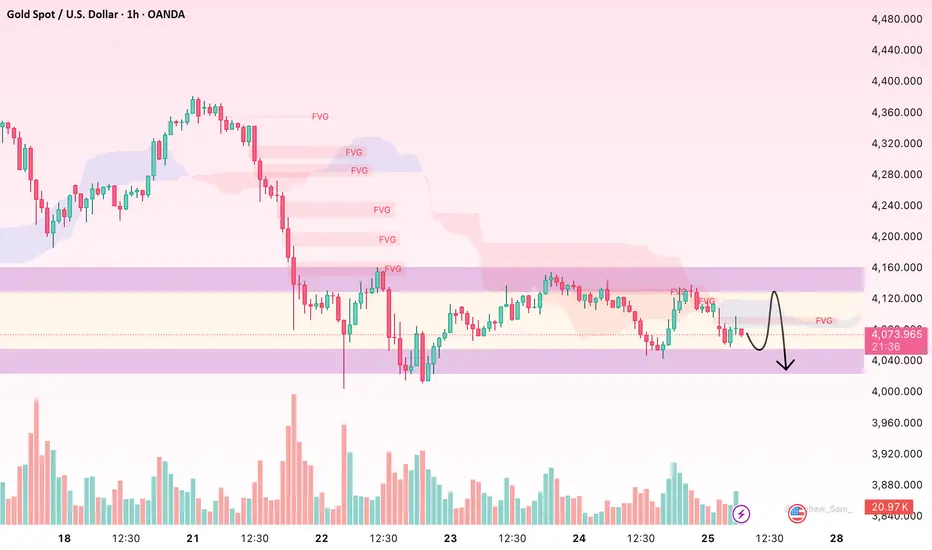

Hello everyone, gold (XAU/USD) is trading around $4,080 after a drop of nearly 7.6% from the $4,380 peak. The decline has paused and the market has moved into a narrow consolidation zone between $4,050 – $4,120, reflecting cautious sentiment before choosing the next direction.

On the 1H chart, we can clearly see a series of Fair Value Gaps (FVG) still lying above price, especially around $4,110 – $4,160 and $4,240 – $4,280 – areas of liquidity that have not yet been reclaimed. However, price remains below the Ichimoku cloud, which means the dominant trend is still bearish. Selling pressure has cooled down, but buyers are not strong enough yet to trigger a confirmed reversal. Trading volume is gradually decreasing, showing that the market is waiting for a catalyst from macro news – consistent with the current environment as investors monitor US–China trade developments and upcoming US economic data.

Structurally, the current bounce appears more like a technical correction rather than a meaningful trend reversal. Gold could continue to recover toward $4,120 – $4,140 to fill nearby FVGs, but this is also a close resistance area where sellers are likely to reappear. If price gets rejected here, $4,040 – $4,000 becomes the next liquidity sweep target. And if $4,000 breaks, the bearish extension could reach $3,960 – $3,920 – a key H4 equilibrium zone where strong demand previously stepped in.

In the short term, I don’t see a sustainable bullish trend unless the Fed signals earlier-than-expected rate cuts or a major geopolitical shock re-ignites safe-haven demand. Without a strong catalyst, the most reasonable scenario is continued consolidation within the $4,000 – $4,200 range before the next major move develops.

What do you see here – technical recovery or a bull trap before the next leg down?

On the 1H chart, we can clearly see a series of Fair Value Gaps (FVG) still lying above price, especially around $4,110 – $4,160 and $4,240 – $4,280 – areas of liquidity that have not yet been reclaimed. However, price remains below the Ichimoku cloud, which means the dominant trend is still bearish. Selling pressure has cooled down, but buyers are not strong enough yet to trigger a confirmed reversal. Trading volume is gradually decreasing, showing that the market is waiting for a catalyst from macro news – consistent with the current environment as investors monitor US–China trade developments and upcoming US economic data.

Structurally, the current bounce appears more like a technical correction rather than a meaningful trend reversal. Gold could continue to recover toward $4,120 – $4,140 to fill nearby FVGs, but this is also a close resistance area where sellers are likely to reappear. If price gets rejected here, $4,040 – $4,000 becomes the next liquidity sweep target. And if $4,000 breaks, the bearish extension could reach $3,960 – $3,920 – a key H4 equilibrium zone where strong demand previously stepped in.

In the short term, I don’t see a sustainable bullish trend unless the Fed signals earlier-than-expected rate cuts or a major geopolitical shock re-ignites safe-haven demand. Without a strong catalyst, the most reasonable scenario is continued consolidation within the $4,000 – $4,200 range before the next major move develops.

What do you see here – technical recovery or a bull trap before the next leg down?

トレード終了: 利益確定目標に到達

Trade Gold, Forex, Bitcoin – the market moves fast, grab your edge today!

👉🏻Join here: t.me/+jBAj1Jdf4vY1NzM1

👉🏻Join here: t.me/+jBAj1Jdf4vY1NzM1

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Trade Gold, Forex, Bitcoin – the market moves fast, grab your edge today!

👉🏻Join here: t.me/+jBAj1Jdf4vY1NzM1

👉🏻Join here: t.me/+jBAj1Jdf4vY1NzM1

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。