🔍 Market Context

Risk sentiment remains fragile as investors reassess the global rate and stimulus story.

Goldman Sachs notes that rising worries about the size of Japan’s fiscal stimulus are bringing financial risk premia back, putting pressure on long-term JGBs and the JPY. Capital tends to rotate into USD and yield-bearing assets in this environment, which limits the upside for gold in the short term.

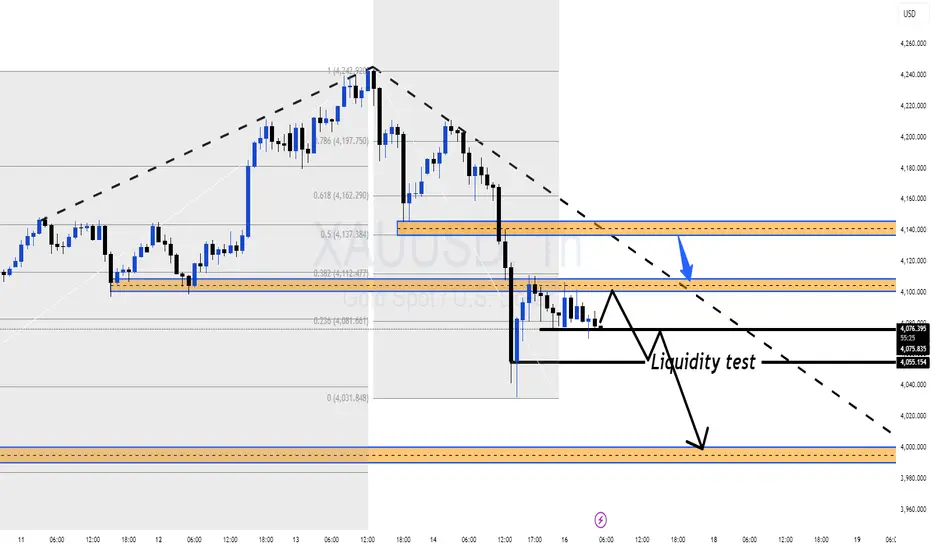

📊 XAU/USD Technical Structure (H1)

After topping around 4,242 USD, gold broke its short-term uptrend and is now moving in a descending structure.

Price is currently capped below the 0.5–0.382 Fibonacci area around 4,11x, which overlaps with a strong supply / Sell Liquidity zone on the chart.

Below price, we have a series of liquidity / support pockets:

4,098 – 4,077 – 4,048 USD: short-term downside liquidity levels.

OBS BUY ZONE around 4,00x: major demand zone where price previously launched a strong rally.

Current price action shows sellers still in control – every bounce into 4,10x–4,14x is being rejected quickly, which fits a “sell the rally” approach.

🎯 Trend-Following Trade Ideas (for reference)

Zones below are technical areas to watch, not signals or financial advice.

Scenario 1 – Shallow Pullback Sell

Sell Zone 1: 4,102 – 4,104

SL: 4,110

TP levels:

TP1: 4,098

TP2: 4,077

TP3: 4,048

Idea: Price makes a minor intraday pullback into local supply, then resumes selling pressure toward lower liquidity pockets.

Scenario 2 – Deeper Pullback into Fib/Trendline Confluence

Sell Zone 2: 4,142 – 4,144

(confluence of descending trendline + Fibonacci combo)

SL: 4,150

TP levels:

TP1: 4,133

TP2: 4,105

TP3: 4,088

TP4: 4,060

Idea: If the market grabs more upside liquidity first, the 4,14x zone offers a better R:R area to align with the H1 downtrend.

⚜️ MMFLOW TRADING View

As long as price stays below 4,14x and H1 structure keeps printing lower highs, gold remains in a distribution phase.

Pullbacks into the 4,10x–4,14x liquidity band are treated as opportunities to optimize SELL entries, while the 4,00x OBS BUY ZONE is the key area to reassess any potential larger bottoming process.

“In a downtrend, our job isn’t to call the bottom – it’s to use every weak bounce to sell from a better position.”

Risk sentiment remains fragile as investors reassess the global rate and stimulus story.

Goldman Sachs notes that rising worries about the size of Japan’s fiscal stimulus are bringing financial risk premia back, putting pressure on long-term JGBs and the JPY. Capital tends to rotate into USD and yield-bearing assets in this environment, which limits the upside for gold in the short term.

📊 XAU/USD Technical Structure (H1)

After topping around 4,242 USD, gold broke its short-term uptrend and is now moving in a descending structure.

Price is currently capped below the 0.5–0.382 Fibonacci area around 4,11x, which overlaps with a strong supply / Sell Liquidity zone on the chart.

Below price, we have a series of liquidity / support pockets:

4,098 – 4,077 – 4,048 USD: short-term downside liquidity levels.

OBS BUY ZONE around 4,00x: major demand zone where price previously launched a strong rally.

Current price action shows sellers still in control – every bounce into 4,10x–4,14x is being rejected quickly, which fits a “sell the rally” approach.

🎯 Trend-Following Trade Ideas (for reference)

Zones below are technical areas to watch, not signals or financial advice.

Scenario 1 – Shallow Pullback Sell

Sell Zone 1: 4,102 – 4,104

SL: 4,110

TP levels:

TP1: 4,098

TP2: 4,077

TP3: 4,048

Idea: Price makes a minor intraday pullback into local supply, then resumes selling pressure toward lower liquidity pockets.

Scenario 2 – Deeper Pullback into Fib/Trendline Confluence

Sell Zone 2: 4,142 – 4,144

(confluence of descending trendline + Fibonacci combo)

SL: 4,150

TP levels:

TP1: 4,133

TP2: 4,105

TP3: 4,088

TP4: 4,060

Idea: If the market grabs more upside liquidity first, the 4,14x zone offers a better R:R area to align with the H1 downtrend.

⚜️ MMFLOW TRADING View

As long as price stays below 4,14x and H1 structure keeps printing lower highs, gold remains in a distribution phase.

Pullbacks into the 4,10x–4,14x liquidity band are treated as opportunities to optimize SELL entries, while the 4,00x OBS BUY ZONE is the key area to reassess any potential larger bottoming process.

“In a downtrend, our job isn’t to call the bottom – it’s to use every weak bounce to sell from a better position.”

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。