🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

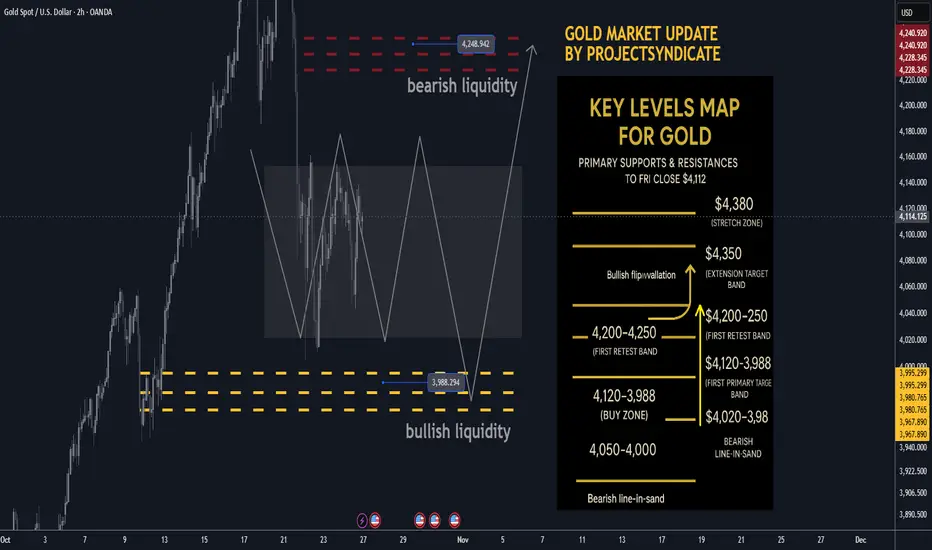

🏆 High/Close: $4,380 → ~$4,112 — lower close within range; momentum cooled but holding the $4,000 handle.

📈 Trend: Uptrend intact > $4,000; oversold into $4.1k—setup favors reflex bounce.

🛡 Supports: $4,120–$4,080 → $4,020–$3,988 (bullish liquidity) → $4,000/3,980 must hold.

🚧 Resistances: $4,200 / $4,250 (bearish liquidity) / $4,300 → stretch $4,350–$4,380.

🧭 Bias next week: Buy-the-dip $4,020–$3,988; momentum regain above $4,200 targets $4,250 → $4,300–$4,350. Invalidation < $3,980 risks a deeper flush to $3,950.

🌍 Macro tailwinds:

• Policy: Easing real yields supportive on dips.

• FX: Softer USD tone = constructive backdrop.

• Flows: Central-bank buying + tactical ETF interest underpin $4k.

• Geopolitics: Trade/tariff & regional tensions keep safety bids alive.

🎯 Street view: Select houses still float $5,000/oz by 2026 on policy easing & reserve-diversification narratives.

________________________________________

🔝 Key Resistance Zones

• $4,200–$4,230 immediate supply from the weekly close

• $4,250 bearish liquidity / primary target

• $4,300–$4,350 extension band

• $4,380 prior spike high / stretch

🛡 Support Zones

• $4,120–$4,080 first retest band below close

• $4,020–$3,988 buy zone (bullish liquidity)

• $4,000 / $3,980 must-hold shelf

________________________________________

⚖️ Base Case Scenario

Expect pullbacks into $4,120–$4,080 and $4,020–$3,988 to attract buyers, rotating price back toward $4,200 then $4,250. Acceptance above $4,250 invites a drive into $4,300–$4,350.

🚀 Breakout Trigger

A sustained push/acceptance > ~$4,250 unlocks $4,300 → $4,350, with room toward $4,380 if momentum persists.

💡 Market Drivers

• Real-yield drift lower (supportive carry backdrop)

• USD softness aiding metals

• Ongoing CB accumulation; ETF flows stabilizing on dips

• Headline risk (trade/geopolitics) sustaining safe-haven demand

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,020–$4,100 (buyers defend pullbacks)

• Bearish below: $3,980 (risk expands; threatens $3,950)

🧭 Strategy

Buy low from bullish liquidity (~$3,988) with a target at $4,250; oversold conditions favor a strong bounce. Add on strength above $4,200 toward $4,300–$4,350. Keep risk tight below $3,980–$4,000 to invalidate.

🏆 High/Close: $4,380 → ~$4,112 — lower close within range; momentum cooled but holding the $4,000 handle.

📈 Trend: Uptrend intact > $4,000; oversold into $4.1k—setup favors reflex bounce.

🛡 Supports: $4,120–$4,080 → $4,020–$3,988 (bullish liquidity) → $4,000/3,980 must hold.

🚧 Resistances: $4,200 / $4,250 (bearish liquidity) / $4,300 → stretch $4,350–$4,380.

🧭 Bias next week: Buy-the-dip $4,020–$3,988; momentum regain above $4,200 targets $4,250 → $4,300–$4,350. Invalidation < $3,980 risks a deeper flush to $3,950.

🌍 Macro tailwinds:

• Policy: Easing real yields supportive on dips.

• FX: Softer USD tone = constructive backdrop.

• Flows: Central-bank buying + tactical ETF interest underpin $4k.

• Geopolitics: Trade/tariff & regional tensions keep safety bids alive.

🎯 Street view: Select houses still float $5,000/oz by 2026 on policy easing & reserve-diversification narratives.

________________________________________

🔝 Key Resistance Zones

• $4,200–$4,230 immediate supply from the weekly close

• $4,250 bearish liquidity / primary target

• $4,300–$4,350 extension band

• $4,380 prior spike high / stretch

🛡 Support Zones

• $4,120–$4,080 first retest band below close

• $4,020–$3,988 buy zone (bullish liquidity)

• $4,000 / $3,980 must-hold shelf

________________________________________

⚖️ Base Case Scenario

Expect pullbacks into $4,120–$4,080 and $4,020–$3,988 to attract buyers, rotating price back toward $4,200 then $4,250. Acceptance above $4,250 invites a drive into $4,300–$4,350.

🚀 Breakout Trigger

A sustained push/acceptance > ~$4,250 unlocks $4,300 → $4,350, with room toward $4,380 if momentum persists.

💡 Market Drivers

• Real-yield drift lower (supportive carry backdrop)

• USD softness aiding metals

• Ongoing CB accumulation; ETF flows stabilizing on dips

• Headline risk (trade/geopolitics) sustaining safe-haven demand

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,020–$4,100 (buyers defend pullbacks)

• Bearish below: $3,980 (risk expands; threatens $3,950)

🧭 Strategy

Buy low from bullish liquidity (~$3,988) with a target at $4,250; oversold conditions favor a strong bounce. Add on strength above $4,200 toward $4,300–$4,350. Keep risk tight below $3,980–$4,000 to invalidate.

ノート

🎁Please hit the like button and🎁Leave a comment to support our team!

ノート

let me know your thoughts on the above in the comments section 🔥🏧🚀ノート

1️⃣ High/Close: $4,380 → $4,112 — momentum cooled but trend intact.2️⃣ Trend: Still bullish above $4,000; oversold = bounce setup.

3️⃣ Supports: $4,120–$4,080 → $4,020–$3,988 💪

4️⃣ Resistances: $4,200 / $4,250 / $4,300–$4,350 🚧

5️⃣ Bias: Buy dips near $4,020–$3,988 → target $4,250–$4,350.

6️⃣ Invalidation: < $3,980 = bearish risk ⚠️

7️⃣ Macro tailwinds: Soft USD, lower yields, CB buying 🌍

8️⃣ Breakout: > $4,250 opens $4,300–$4,380 🚀

9️⃣ Street view: $5,000/oz by 2026 still on table 🎯

🔟 Strategy: Accumulate dips ➕ hold above $4,000 🧭

ノート

BREAK BELOW 3950/3960 USD EXPOSES FURTHER DOWNSIDE TARGETSTP1 3900 USD TP2 3850 USD.

ノート

🚨 GOLD MARKET CORRECTION: THE BULL PAUSES BUT NOT DEAD 🚨💰 Gold peaked at $4,380, now sliding — momentum shifted to bears.

📉 Broke $4,000, spot near $3,920 — correction phase confirmed.

🔥 Overheated positioning + ETF outflows triggered the unwind.

⚙️ Next support: $3,750 → $3,500 key psychological zones.

🏦 Macro catalysts: Treasury refunding (Nov 5) & Fed minutes (Nov 19).

💵 Rising real yields / USD strength adding short-term pressure.

📊 ETF + COT flows will signal when washout ends.

🌏 India/China demand could stabilize spot in coming weeks.

🧭 Range view: $3,500–$4,100 over next 4–8 weeks.

🚀 Big picture: Still a bull market correction — reload zone coming soon.

トレード稼働中

BREAK BELOW 3950/3960 USD EXPOSES FURTHER DOWNSIDE TARGETSTP1 3900 USD TP2 3850 USD. TP1 HIT ALREADY.

ノート

outlook flipped bearish. see latest update. broke down below 4000 usd.this exposes further downside targets at 3750 and 3500 usd.

ノート

🪙 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE🏆 High/Close: $4,108 → $4,002 — tight, inside-week feel after last week’s shakeout.

📈 Trend: Uptrend intact > $4,000 — buyers defend round-number pivot.

🛡 Supports: $4,020–$3,990 → $4,000 must hold.

🚧 Resistances: $4,120 / $4,180 / $4,220 → stretch $4,260.

🧭 Bias next week: Buy-the-dip > $4,000; momentum regain eyes $4,120–$4,220+. Invalidation < $3,980 → risk $3,940/3,900.

🌍 Macro tailwinds : Cut odds still live; USD/yields mixed; CB demand steady. FOMC reaction: mostly flat; Powell cautious, markets priced-in.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。