🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

🏆 High/Close: $4,108 → ~$4,002 — sellers defended overhead; weekly close soft within range.

📈 Trend: Neutral / correction mode still ON; not expecting new highs near term.

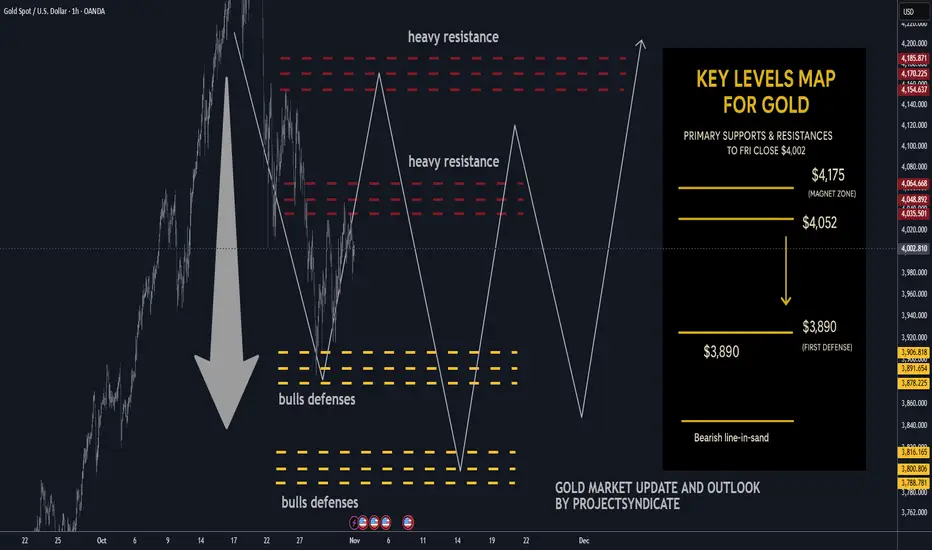

🛡 Supports: $3,890 → $3,800 — pivotal shelves for downside containment.

🚧 Resistances: $4,052 / $4,175 — magnet zones for supply / fade attempts.

🧭 Bias next week: Prefer short sells into $4,052–$4,175 with take-profit toward $3,890 → $3,800. Invalidation on sustained reclaim > $4,175; failure of $3,800 risks extension lower.

🌍 Macro tailwinds/headwinds :

• Rates: Real yields stable-to-firm keep upside contained; any dovish surprise could spark squeezes into resistance.

• FX: DXY mixed—lack of broad USD weakness limits impulse follow-through.

• Flows: CB/ETF demand supportive on deep dips but tepid near highs.

• Geopolitics: Event risk provides intermittent bids; not a trend driver this week.

🎯 Street view: Medium-term bullish narratives reserve diversification, policy easing into 2026 remain, but near-term tape favors mean-reversion lower under resistance.

________________________________________

🔝 Key Resistance Zones

• $4,052 — immediate ceiling; prior supply pivot likely to cap first tests

• $4,175 — upper resistance; acceptance above flips tone from corrective to constructive

🛡 Support Zones

• $3,890 — first defense; loss invites momentum probes

• $3,800 — critical structural base; break risks downside acceleration

________________________________________

⚖️ Base Case Scenario

Range-to-soft trade within $3,800–$4,175. Rallies into $4,052–$4,175 are sellable; expect rotations back toward $3,890 with scope to $3,800 if sellers press.

🚀 Breakout Trigger

Only a sustained acceptance > ~$4,175 negates the correction and opens $4,200+ pathing; conversely, firm rejection at $4,052 with a daily close < $3,890 increases odds of a $3,800 test.

💡 Market Drivers

• Fed path & real-yield drift

• USD index swings

• ETF/CB flow tone on dips vs. rips

• Risk sentiment headlines (geopolitics/trade)

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,175 correction phase likely over if held

• Bearish below: $3,890 → risk expands under $3,800

🧭 Strategy

Short-sell from overhead resistances ($4,052 → $4,175).

Scale profits into $3,890 then $3,800; keep stops tight above trigger levels. Stand aside on fresh longs until sustained reclaim above $4,175 reasserts momentum.

🏆 High/Close: $4,108 → ~$4,002 — sellers defended overhead; weekly close soft within range.

📈 Trend: Neutral / correction mode still ON; not expecting new highs near term.

🛡 Supports: $3,890 → $3,800 — pivotal shelves for downside containment.

🚧 Resistances: $4,052 / $4,175 — magnet zones for supply / fade attempts.

🧭 Bias next week: Prefer short sells into $4,052–$4,175 with take-profit toward $3,890 → $3,800. Invalidation on sustained reclaim > $4,175; failure of $3,800 risks extension lower.

🌍 Macro tailwinds/headwinds :

• Rates: Real yields stable-to-firm keep upside contained; any dovish surprise could spark squeezes into resistance.

• FX: DXY mixed—lack of broad USD weakness limits impulse follow-through.

• Flows: CB/ETF demand supportive on deep dips but tepid near highs.

• Geopolitics: Event risk provides intermittent bids; not a trend driver this week.

🎯 Street view: Medium-term bullish narratives reserve diversification, policy easing into 2026 remain, but near-term tape favors mean-reversion lower under resistance.

________________________________________

🔝 Key Resistance Zones

• $4,052 — immediate ceiling; prior supply pivot likely to cap first tests

• $4,175 — upper resistance; acceptance above flips tone from corrective to constructive

🛡 Support Zones

• $3,890 — first defense; loss invites momentum probes

• $3,800 — critical structural base; break risks downside acceleration

________________________________________

⚖️ Base Case Scenario

Range-to-soft trade within $3,800–$4,175. Rallies into $4,052–$4,175 are sellable; expect rotations back toward $3,890 with scope to $3,800 if sellers press.

🚀 Breakout Trigger

Only a sustained acceptance > ~$4,175 negates the correction and opens $4,200+ pathing; conversely, firm rejection at $4,052 with a daily close < $3,890 increases odds of a $3,800 test.

💡 Market Drivers

• Fed path & real-yield drift

• USD index swings

• ETF/CB flow tone on dips vs. rips

• Risk sentiment headlines (geopolitics/trade)

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,175 correction phase likely over if held

• Bearish below: $3,890 → risk expands under $3,800

🧭 Strategy

Short-sell from overhead resistances ($4,052 → $4,175).

Scale profits into $3,890 then $3,800; keep stops tight above trigger levels. Stand aside on fresh longs until sustained reclaim above $4,175 reasserts momentum.

ノート

🔥 GOLD WEEKLY SNAPSHOT — PROJECTSYNDICATE🏆 High/Close: $4,108 → $4,002 — soft finish; sellers capped upside.

📈 Trend: Neutral / correction mode still ON — no new highs expected.

🛡 Supports: $3,890 → $3,800 — key downside floors.

🚧 Resistances: $4,052 / $4,175 — strong overhead supply zones.

🧭 Bias: Short-sell into $4,052–$4,175 → targets $3,890–$3,800.

💣 Invalidation: Reclaim > $4,175 flips tone bullish; below $3,800 = deeper risk.

🌍 Macro: Stable yields & firm USD cap upside; dips supported by CB/ETF flows.

⚖️ Range View: Trade remains $3,800–$4,175 — rallies likely to fade.

🚀 Trigger: Sustained > $4,175 = breakout; < $3,890 = renewed weakness.

🎯 Strategy: Sell resistance, take profit near supports; avoid longs for now.

ノート

let me know your thoughts on the above in the comments section 🔥🏧🚀ノート

🎁Please hit the like button and🎁Leave a comment to support our team!

ノート

🪙 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE🏆 High/Close: $4,030 → $4,000 — range compression after prior volatility; tighter, indecisive week.

📉 Trend: Uptrend softens but still above key pivot; buyers holding the line near $4,000.

🛡 Supports: $3,980 / $3,940 → $4,000 remains short-term must-hold.

🚧 Resistances: $4,040 / $4,080 / $4,120 → stretch $4,160.

🧭 Bias next week: Neutral-to-slightly bearish; muted tone favors range-trade between $3,940–$4,080. Re-acceleration only above $4,100. Break below $3,940 opens $3,900.

🌍 Macro backdrop: Fed cut odds steady; USD/yields drift; central-bank demand resilient. No strong catalyst seen — expect quieter consolidation week.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。