INVITE-ONLY SCRIPT

MarketReader_Strategy

アップデート済

MarketReader_Strategy is a very useful and advanced indicator:

- It draws buying (green) and selling (orange) zone.

-Once the buying or selling zone is tapped, the color is automatically changed to grey

-It shows liquidity pool ($$$) engineered by market behaviour

Buying or selling area are determined by an algorithm that combines volume profile, Elliott Wave principles and order flow delivery.

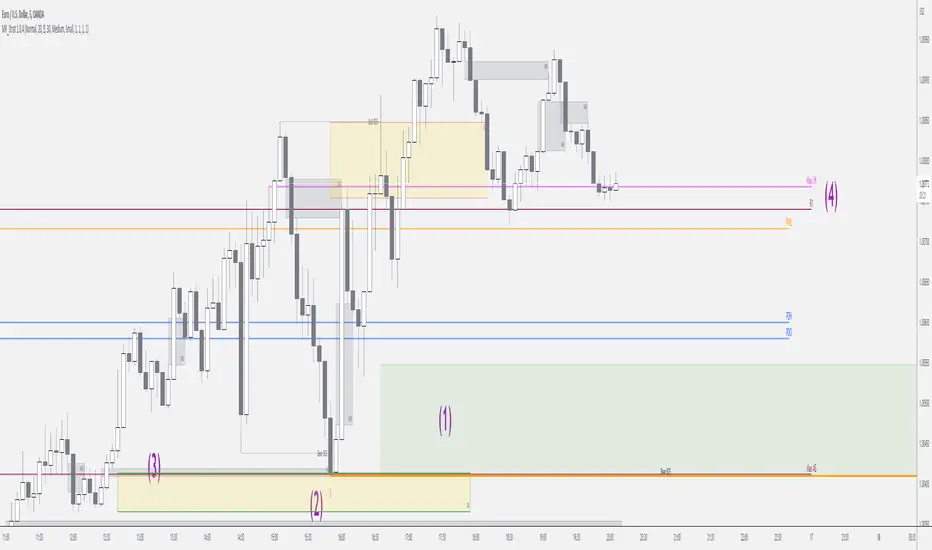

On the above example:

At “1”, you can see that the first buying zone is drawn since January 12

At “2”, the buying zone is tapped on January 18 with a strong bullish reaction.

At “3” and “3’”, you can see that liquidity pool has been created by market maker on both buying and selling side. It is typical of market behavior.

Market maker will take the downside liquidity by targeting the buying zone and then reverse (to the upside) targeting the upside liquidity pool that fuel the pump to the selling zone “4”. This selling zone is reached at “5” with a strong bearish reaction.

“6” represent active buying zone, waiting to be tapped.

To buy or take profit on these areas will depend on market behavior on the way down. Does the market engineer liquidity before? We use 2 complementary indicators helping us to take position on these areas but feel free to experiment with your own.

Usually, I wait price comes to selling or buying zone, then I go on lower timeframe (15 to 30 times lower) searching for divergences and convergences on Momemtum reader (also available on tradingview)

This indicator does not repaint and works on Forex, Crypto, Indices, Commodities and stock.

- It draws buying (green) and selling (orange) zone.

-Once the buying or selling zone is tapped, the color is automatically changed to grey

-It shows liquidity pool ($$$) engineered by market behaviour

Buying or selling area are determined by an algorithm that combines volume profile, Elliott Wave principles and order flow delivery.

On the above example:

At “1”, you can see that the first buying zone is drawn since January 12

At “2”, the buying zone is tapped on January 18 with a strong bullish reaction.

At “3” and “3’”, you can see that liquidity pool has been created by market maker on both buying and selling side. It is typical of market behavior.

Market maker will take the downside liquidity by targeting the buying zone and then reverse (to the upside) targeting the upside liquidity pool that fuel the pump to the selling zone “4”. This selling zone is reached at “5” with a strong bearish reaction.

“6” represent active buying zone, waiting to be tapped.

To buy or take profit on these areas will depend on market behavior on the way down. Does the market engineer liquidity before? We use 2 complementary indicators helping us to take position on these areas but feel free to experiment with your own.

Usually, I wait price comes to selling or buying zone, then I go on lower timeframe (15 to 30 times lower) searching for divergences and convergences on Momemtum reader (also available on tradingview)

This indicator does not repaint and works on Forex, Crypto, Indices, Commodities and stock.

リリースノート

Minor bug correctionリリースノート

Minor bug correctionリリースノート

Major update:-Optimisation of Orderblock/POI/Supply/demand zone filtering

-Adding FVG-Imbalance plotting

-Automatic plot of Asian range High-Low and its SD (S1-2 R1-2)

-Automatic plot of London High-Low

-Automatic plot of Previous Daily and Weekly High and Low

-Automatic plot of Liquidity pool ($ symbol)

So many people think that POI/OB/Supply-Demand zone are just the last bullish or bearish candle but it is more complicated than that. Our algorithm performs an advanced filtering according to volume, market structure, and oderflow.

All options are customizable.

in the graph:

(1) Untouched OrderBlock/POI/etc

(2) Consummed OrderBloc/POI/etc => Nice bounce on it ;-)

(3) Imbalance juste above OB

(4) London and Asian High-Low// Previous daily and Weekly High-Low

リリースノート

Minor update:-correction of Volatility support and resistance

-Add option

招待専用スクリプト

このスクリプトへのアクセスは作者が許可したユーザーに制限されており、通常はお支払いが必要です。お気に入りに追加することはできますが、許可を申請して作者が許可した後でなければ使用することはできません。 詳細については nonobdx にお問い合わせいただくか、以下の作者の指示に従ってください。

スクリプトの動作を理解していて作者も100%信頼できるということでなければ、TradingViewとしてはお金を払ってまでスクリプトを利用するのはお勧めしません。そのかわりに、コミュニティスクリプトでオープンソースの優れたスクリプトが無料で見つけられることが多々あります。

チャートでこのスクリプトを利用したいですか?

注: アクセス権をリクエストされる前にこちらをご覧ください。

Apprendre la méthode:

discord.gg/b7YGtY2

Site internet: marketreader.fr/

Chaine Youtube : youtube.com/channel/UC-a7p8DkfbDM6ONrTzsaErA?view_as=subscriber

discord.gg/b7YGtY2

Site internet: marketreader.fr/

Chaine Youtube : youtube.com/channel/UC-a7p8DkfbDM6ONrTzsaErA?view_as=subscriber

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。