Today, we're taking a deep dive into the two most important charts in the crypto space: Bitcoin (BTC/USDT) and the Total Crypto Market Cap (TOTAL). Using an Elliott Wave framework on the weekly timeframe, we can see a clear bullish structure taking shape. However, some underlying weaknesses in key indicators warrant a cautious approach. Let's break it down.

1. Bitcoin (BTC/USDT): The Path to a new All-time high Hinges on a Key Level

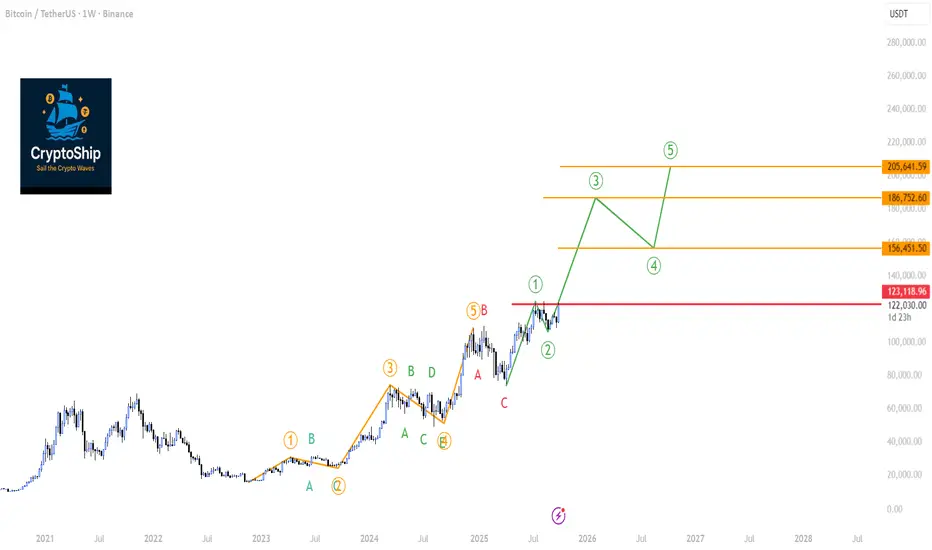

As we can see on the weekly chart, Bitcoin appears to have completed a major five-wave impulse cycle which topped out around the $108,000 mark. This was followed by a necessary ABC corrective phase.

The exciting part is what comes next. We are potentially witnessing the beginning of a brand new five-wave impulse.

Wave (1): Appears to have started from the $74,000 low and peaked near $124,000.

Wave (2): A healthy correction followed, finding support around $107,000.

If this count is valid, we are now in the early stages of Wave (3), which is typically the most powerful and extended wave in an impulse sequence.

The Critical Condition:

For this bullish count to remain the primary scenario, the current weekly candle must NOT close below $123,000. A weekly close below this crucial level would risk invalidating the start of this new impulse, suggesting that we may still be within a more complex corrective structure (such as a regular flat correction Check the article).

Also during wave (3) the Weekly RSI must go beyond "80" showing strong momentum ( if it fails to do so then it's a caution signal to be strongly considered because a reversal could happen at any time!)

Indicator Analysis:

Bearish Divergences: We must note the lingering bearish divergences on both the RSI and MACD. These signals are suspicious and suggest that momentum is not fully confirming the recent price highs. They need to be monitored closely.

Volatility Coiling: The Bollinger Band Width Percentile (BBWP) is showing significant contraction. This coiling of the bands indicates that weekly volatility is decreasing, which often precedes a massive price expansion in the coming weeks or months, However the lack of BBWP exhaustion (spectrum crossing 90%) remains a bullish sign combined with the contraction

Trend Strength: The ADX is rising on the weekly chart, confirming that a strong trend is in progress.

Volume: On-Balance Volume (OBV) and general volume profiles appear adequate for now.

2. Total Crypto Market Cap (TOTAL): The Broader Market Picture

The Total Crypto Market Cap chart tells a very similar story, reinforcing our Bitcoin analysis. The bullish phase began in sync with BTC back in November 2022.

The current Elliott Wave structure for the entire market is as follows:

Wave (1): Completed in March 2024.

Wave (2): Corrected into May 2024.

Wave (3): Finshed on March 2024

Wave (5): Finshed on December 2024

Currently the Total market cap chart is closely alligned with BTC chart which confrims the BTC leadership is intact. The current Elliot count of TOTAL market cap indicated wave (1) started April 2025 but curretly wave 2 showing caution signals

A Significant Red Flag - The Volume Divergence:

While the price structure remains bullish, there's a concerning signal under the hood. On the weekly RSI, we see a double bottom pattern, which is typically bullish. However, looking at the On-Balance Volume (OBV) during the same period, the OBV printed a lower low.

This is a classic bearish divergence between price/momentum and volume. It indicates that the recent push higher is not being supported by genuine, strong volume, suggesting conviction is weak.

Alternative Scenario:

If this volume weakness persists, we might see Wave (2) extenstion to around $3.23 Trillion. This would lead to a deeper Wave (2) correction, From that support, Wave 3 could launch that would still likely reach our ultimate ATH.

Conclusion: Bullish Outlook with a Note of Caution

Bringing both analyses together, the macro view for the crypto market remains decisively bullish. The Elliott Wave structures on both BTC and the TOTAL chart point towards significantly higher valuation, the lack of BBWP exhaustion on weekly charts of BTC & Total market cap remains a strong bullish indication combined with the BBWP expansion.

However, the market is showing signs of fatigue. The bearish divergences on Bitcoin's indicators and the critical volume divergence on the TOTAL chart cannot be ignored. This suggests that while the overall destination is uptrend, the journey might include a corrective dip before the next explosive leg higher.

Key Takeaways:

Overall Bias: Bullish.

Key Level for BTC: Watch the weekly close relative to $123,000. This is our line in the sand for the current impulsive structure.

Key Concern: The lack of strong volume confirming the market's recent move up warrants caution.

Volatility: Brace for a significant expansion in price movement. The compressed BBWP on both charts suggests a major move is brewing.

Stay vigilant and manage your risk accordingly. The next few weekly closes will be critical in determining whether we blast off directly or take a detour first.

1. Bitcoin (BTC/USDT): The Path to a new All-time high Hinges on a Key Level

As we can see on the weekly chart, Bitcoin appears to have completed a major five-wave impulse cycle which topped out around the $108,000 mark. This was followed by a necessary ABC corrective phase.

The exciting part is what comes next. We are potentially witnessing the beginning of a brand new five-wave impulse.

Wave (1): Appears to have started from the $74,000 low and peaked near $124,000.

Wave (2): A healthy correction followed, finding support around $107,000.

If this count is valid, we are now in the early stages of Wave (3), which is typically the most powerful and extended wave in an impulse sequence.

The Critical Condition:

For this bullish count to remain the primary scenario, the current weekly candle must NOT close below $123,000. A weekly close below this crucial level would risk invalidating the start of this new impulse, suggesting that we may still be within a more complex corrective structure (such as a regular flat correction Check the article).

Also during wave (3) the Weekly RSI must go beyond "80" showing strong momentum ( if it fails to do so then it's a caution signal to be strongly considered because a reversal could happen at any time!)

Indicator Analysis:

Bearish Divergences: We must note the lingering bearish divergences on both the RSI and MACD. These signals are suspicious and suggest that momentum is not fully confirming the recent price highs. They need to be monitored closely.

Volatility Coiling: The Bollinger Band Width Percentile (BBWP) is showing significant contraction. This coiling of the bands indicates that weekly volatility is decreasing, which often precedes a massive price expansion in the coming weeks or months, However the lack of BBWP exhaustion (spectrum crossing 90%) remains a bullish sign combined with the contraction

Trend Strength: The ADX is rising on the weekly chart, confirming that a strong trend is in progress.

Volume: On-Balance Volume (OBV) and general volume profiles appear adequate for now.

2. Total Crypto Market Cap (TOTAL): The Broader Market Picture

The Total Crypto Market Cap chart tells a very similar story, reinforcing our Bitcoin analysis. The bullish phase began in sync with BTC back in November 2022.

The current Elliott Wave structure for the entire market is as follows:

Wave (1): Completed in March 2024.

Wave (2): Corrected into May 2024.

Wave (3): Finshed on March 2024

Wave (5): Finshed on December 2024

Currently the Total market cap chart is closely alligned with BTC chart which confrims the BTC leadership is intact. The current Elliot count of TOTAL market cap indicated wave (1) started April 2025 but curretly wave 2 showing caution signals

A Significant Red Flag - The Volume Divergence:

While the price structure remains bullish, there's a concerning signal under the hood. On the weekly RSI, we see a double bottom pattern, which is typically bullish. However, looking at the On-Balance Volume (OBV) during the same period, the OBV printed a lower low.

This is a classic bearish divergence between price/momentum and volume. It indicates that the recent push higher is not being supported by genuine, strong volume, suggesting conviction is weak.

Alternative Scenario:

If this volume weakness persists, we might see Wave (2) extenstion to around $3.23 Trillion. This would lead to a deeper Wave (2) correction, From that support, Wave 3 could launch that would still likely reach our ultimate ATH.

Conclusion: Bullish Outlook with a Note of Caution

Bringing both analyses together, the macro view for the crypto market remains decisively bullish. The Elliott Wave structures on both BTC and the TOTAL chart point towards significantly higher valuation, the lack of BBWP exhaustion on weekly charts of BTC & Total market cap remains a strong bullish indication combined with the BBWP expansion.

However, the market is showing signs of fatigue. The bearish divergences on Bitcoin's indicators and the critical volume divergence on the TOTAL chart cannot be ignored. This suggests that while the overall destination is uptrend, the journey might include a corrective dip before the next explosive leg higher.

Key Takeaways:

Overall Bias: Bullish.

Key Level for BTC: Watch the weekly close relative to $123,000. This is our line in the sand for the current impulsive structure.

Key Concern: The lack of strong volume confirming the market's recent move up warrants caution.

Volatility: Brace for a significant expansion in price movement. The compressed BBWP on both charts suggests a major move is brewing.

Stay vigilant and manage your risk accordingly. The next few weekly closes will be critical in determining whether we blast off directly or take a detour first.

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。