Gold Update Today – Watching FOMC in the US Session

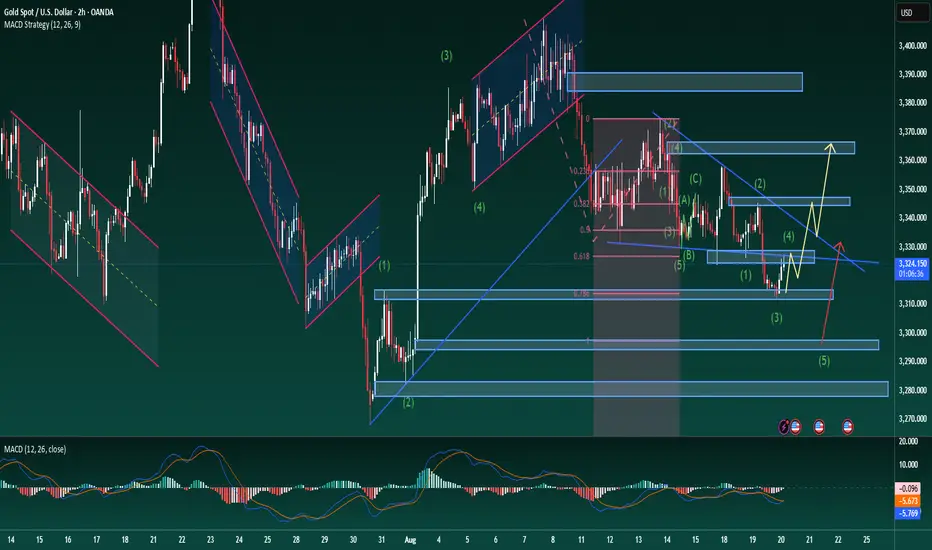

After yesterday’s sharp drop below 3312 and a strong bounce from key support, gold is now consolidating sideways, building liquidity for the next move. From the current outlook, a corrective rebound seems likely before the broader downtrend resumes.

Looking at structure, the descending channel remains intact, with price respecting the main trendline and notably breaking out of yesterday’s triangle formation — reinforcing the bearish bias.

From an Elliott Wave perspective, the market may be forming wave 4. If this rebound carries price back towards 3325–3330, it will retest a strong resistance zone that has rejected price multiple times before. Should that happen, wave 5 could begin — and theory suggests it is often the strongest leg.

Fibonacci levels point to the next support near 3295. If tonight’s FOMC outcome strengthens the US dollar, gold could even extend deeper towards 3280.

In the short term, traders may consider buying near 3316 with a tight stop just below the recent low, targeting the corrective move of wave 4. On the flip side, if price reacts at 3325–3330, this could provide a selling opportunity into wave 5, with scope for a 40–50 dollar extension if momentum holds.

On the daily chart, gold has tested the long-term ascending trendline and bounced strongly, which may indicate that a fresh support base is being established.

A sustainable trend is always built on alternating impulses and corrections. Patience in waiting for confirmation often leads to stronger setups than rushing into trades.

Do you think the FOMC this month will announce a positive interest rate outlook? Share your thoughts in the comments.

#XAUUSD #Gold #TechnicalAnalysis #PriceAction #ElliottWave #Trendline #MACD #Forex #UKTrading #FOMC

After yesterday’s sharp drop below 3312 and a strong bounce from key support, gold is now consolidating sideways, building liquidity for the next move. From the current outlook, a corrective rebound seems likely before the broader downtrend resumes.

Looking at structure, the descending channel remains intact, with price respecting the main trendline and notably breaking out of yesterday’s triangle formation — reinforcing the bearish bias.

From an Elliott Wave perspective, the market may be forming wave 4. If this rebound carries price back towards 3325–3330, it will retest a strong resistance zone that has rejected price multiple times before. Should that happen, wave 5 could begin — and theory suggests it is often the strongest leg.

Fibonacci levels point to the next support near 3295. If tonight’s FOMC outcome strengthens the US dollar, gold could even extend deeper towards 3280.

In the short term, traders may consider buying near 3316 with a tight stop just below the recent low, targeting the corrective move of wave 4. On the flip side, if price reacts at 3325–3330, this could provide a selling opportunity into wave 5, with scope for a 40–50 dollar extension if momentum holds.

On the daily chart, gold has tested the long-term ascending trendline and bounced strongly, which may indicate that a fresh support base is being established.

A sustainable trend is always built on alternating impulses and corrections. Patience in waiting for confirmation often leads to stronger setups than rushing into trades.

Do you think the FOMC this month will announce a positive interest rate outlook? Share your thoughts in the comments.

#XAUUSD #Gold #TechnicalAnalysis #PriceAction #ElliottWave #Trendline #MACD #Forex #UKTrading #FOMC

💠Accurate signals 🥉 a standardised trading system.

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

💠Accurate signals 🥉 a standardised trading system.

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。